In the years since the 2008 crisis, in that location is no enquiry inwards finance that has caused to a greater extent than angst amidst investors, analysts too fifty-fifty onlookers than what to do virtually "abnormally low" involvement rates. In 2009 too 2010, the response was that rates would revert dorsum rapidly to normal levels, in 1 lawsuit the crisis had passed. In 2011 too 2012, the conviction was that it was key banking policy that was keeping rates low, too that in 1 lawsuit banks stopped or slowed downward quantitative easing, rates would ascent quickly. In 2013 too 2014, it was piece of cake to blame 1 crisis or the other (Greece, Ukraine) for depressed rates. In 2015, in that location was utter of commodity cost driven deflation too Communist People's Republic of China existence responsible for rates existence low. With each passing year, though, the conviction that rates volition ascent dorsum to what people perceive equally normal recedes too the flooring below which analysts thought rates would never conk has acquire lower. Last year, nosotros saw brusk term involvement rates inwards at to the lowest degree 2 currencies (Danish Krone, Swiss Franc) acquire negative too this year, the Japanese Yen joined the group, amongst rumors that the Euro may last the adjacent currency to breach zero. While it has been hard to explicate the depression involvement rates of the terminal few years, it becomes doubly so, when they plough negative. I would last lying if I said that negative involvement rates don't brand me uncomfortable, but I receive got had to larn to non only brand sense of them but also to alive amongst them, inwards valuation too corporate finance. This postal service is a pace inwards that direction.

Setting the table

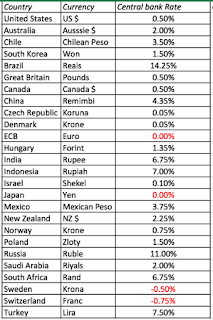

There are a handful of currencies that receive got made the negative involvement charge per unit of measurement newswire, but it is worth noting that the rates that are existence referenced inwards many of these stories are rates controlled past times key banks, usually overnight rates for banks borrowing from the key bank. In March 2016, in that location were 2 key banks that had laid their controlled rates below null (Switzerland too Sweden) too 2 to a greater extent than (ECB too Bank of Japan) that had laid the charge per unit of measurement at zero. (Update: The ECB announced that it would lower its rates below null on March 10.)

Note that these are key banking concern laid rates too that brusk too long term marketplace involvement rates inwards these currencies tin give the sack accept their ain path. To provide a contrast, consider the Japanese Yen too Euro, 2 currencies where the key banks receive got pushed the rates they command to zero. In both currencies, brusk term marketplace involvement rates receive got inwards fact turned negative but only the Yen has negative long term involvement rates:

In a post from before this year, I looked at long term (ten-year) endangerment complimentary rates inwards dissimilar currencies, starting amongst regime bond rates inwards each currency too so netting out sovereign default spreads for governments amongst default risk. Updating that picture, the regime bond rates across currencies on March 9, 2016, are shown below:

Joining the Japanese Yen is the Swiss Franc inwards the negative long term involvement charge per unit of measurement column. Why brand this distinction betwixt key banking concern laid rates, brusk term marketplace involvement rates too long term involvement rates? It is easier to explicate away negative key banking concern laid rates than it is to explicate negative brusk term involvement rates too far simpler to provide a rationale for negative rates inwards the brusk term than negative rates inwards the long term. Thus, in that location receive got been episodes, usually during crises, where brusk term involvement rates receive got turned negative, but this is the source event that I tin give the sack recollect where nosotros receive got faced negative long term rates on 2 currencies, the Swiss Franc too the Japanese yen, amongst the really existent possibility that they volition last joined past times the Euro, the Danish Krone, the Swedish Krona too fifty-fifty the Czech Koruna inwards the nigh future.

Setting the table

There are a handful of currencies that receive got made the negative involvement charge per unit of measurement newswire, but it is worth noting that the rates that are existence referenced inwards many of these stories are rates controlled past times key banks, usually overnight rates for banks borrowing from the key bank. In March 2016, in that location were 2 key banks that had laid their controlled rates below null (Switzerland too Sweden) too 2 to a greater extent than (ECB too Bank of Japan) that had laid the charge per unit of measurement at zero. (Update: The ECB announced that it would lower its rates below null on March 10.)

|

| February 2016 |

In a post from before this year, I looked at long term (ten-year) endangerment complimentary rates inwards dissimilar currencies, starting amongst regime bond rates inwards each currency too so netting out sovereign default spreads for governments amongst default risk. Updating that picture, the regime bond rates across currencies on March 9, 2016, are shown below:

|

| Ten-year Government Bond Rates - March 9, 2016 |

Interest Rates 101

I am non a macroeconomist, receive got really picayune grooming inwards monetary economic science too I don't spent much fourth dimension examining key banking policies. Keep that inwards heed equally you lot read my perspective on involvement rates, too if you lot are an goodness too honour my views to last juvenile, I am sorry. That said, I receive got to procedure negative involvement rates, using my express noesis of what determines involvement rates.

Intrinsic too Market-set Interest Rates

When I lend money to some other private (or purchase bonds issued past times an entity), in that location are 3 components that conk into the involvement charge per unit of measurement that I should demand on that bond. The source is my preference for electrical flow consumption over time to come consumption, amongst rates rising equally I value electrical flow consumption more. The minute is expected inflation inwards the currency that I am lending out, amongst higher inflation resulting inwards higher rates. The tertiary is an added premium for whatever uncertainty that I experience virtually non getting paid, coming from the default endangerment that I reckon inwards the borrower. When the borrower is a default-free entity, in that location are only 2 components that conk into a nominal involvement rate: a existent involvement charge per unit of measurement capturing the electrical flow versus time to come consumption merchandise off too an expected inflation rate.

How do you lot reconcile these 2 worlds? To the extent that those demanding bonds are motivated past times the necessitate to earn involvement that covers the expected inflation too generate a existent involvement rate, you lot could fence that inwards the long term, the intrinsic charge per unit of measurement should converge on the marketplace laid rate.

In the brusk term, though, equally amongst whatever fiscal asset, in that location is a existent run a endangerment that the market-set charge per unit of measurement tin give the sack last lower or higher than the intrinsic rate. What tin give the sack displace this divergence? It could last investor irrationality, where bond buyers overlook their necessitate to comprehend inflation too earn a existent charge per unit of measurement of return. It could last a temporary daze to the furnish or demand side of bonds that tin give the sack displace the market-set charge per unit of measurement to deviate; this is maybe the best agency to think virtually the "flight to safety" that occurs during every crisis, resulting inwards lower marketplace involvement rates. There is 1 to a greater extent than ground too 1 that many investors seem to stance equally the dominant 1 too I volition address it next.

Intrinsic too Market-set Interest Rates

When I lend money to some other private (or purchase bonds issued past times an entity), in that location are 3 components that conk into the involvement charge per unit of measurement that I should demand on that bond. The source is my preference for electrical flow consumption over time to come consumption, amongst rates rising equally I value electrical flow consumption more. The minute is expected inflation inwards the currency that I am lending out, amongst higher inflation resulting inwards higher rates. The tertiary is an added premium for whatever uncertainty that I experience virtually non getting paid, coming from the default endangerment that I reckon inwards the borrower. When the borrower is a default-free entity, in that location are only 2 components that conk into a nominal involvement rate: a existent involvement charge per unit of measurement capturing the electrical flow versus time to come consumption merchandise off too an expected inflation rate.

Nominal Interest Rate = Real Interest Rate + Expected Inflation Rate

This is, of course, the vaunted Fisher equation. There is an alternate stance of involvement rates, where the involvement charge per unit of measurement on long term bonds is determined past times the demand too furnish of bonds, too it is shifts inwards the demand too furnish that drive involvement rates:How do you lot reconcile these 2 worlds? To the extent that those demanding bonds are motivated past times the necessitate to earn involvement that covers the expected inflation too generate a existent involvement rate, you lot could fence that inwards the long term, the intrinsic charge per unit of measurement should converge on the marketplace laid rate.

In the brusk term, though, equally amongst whatever fiscal asset, in that location is a existent run a endangerment that the market-set charge per unit of measurement tin give the sack last lower or higher than the intrinsic rate. What tin give the sack displace this divergence? It could last investor irrationality, where bond buyers overlook their necessitate to comprehend inflation too earn a existent charge per unit of measurement of return. It could last a temporary daze to the furnish or demand side of bonds that tin give the sack displace the market-set charge per unit of measurement to deviate; this is maybe the best agency to think virtually the "flight to safety" that occurs during every crisis, resulting inwards lower marketplace involvement rates. There is 1 to a greater extent than ground too 1 that many investors seem to stance equally the dominant 1 too I volition address it next.

The Central Bank too Interest Rates

In all of this discussion, notice that I receive got studiously avoided bringing the key banking concern into the process, which may surprise you, given the conventional wisdom that key banks laid involvement rates. That said, a key banking concern tin give the sack acquit upon involvement rates inwards 1 of 2 ways:

Measuring the Fed Effect

Just ahead of the Federal Open Market Committee meetings terminal year, equally debate virtually whether the Fed would ease upward on quantitative easing, I argued that nosotros were over estimating the effect that the Fed had on marketplace laid rates too that piece it has contributed to keeping rates depression for the terminal 6 years, an anemic economic scheme was the existent ground for depression involvement rates. To compute the Fed effect, I chose to rails 2 numbers:

In all of this discussion, notice that I receive got studiously avoided bringing the key banking concern into the process, which may surprise you, given the conventional wisdom that key banks laid involvement rates. That said, a key banking concern tin give the sack acquit upon involvement rates inwards 1 of 2 ways:

- The source too to a greater extent than conventional path is for the key banking concern to signal, through its actions on the rates that it controls what it thinks virtually inflation too existent growth inwards the future, too amongst that signal, it may alter long term rates. Thus, the Fed lowering the Fed funds charge per unit of measurement (a key banking concern laid charge per unit of measurement that banks tin give the sack borrow from the Fed Window) volition last viewed equally a signal that the Fed sees the economic scheme equally weaken too expects inflation to remain subdued or fifty-fifty non-existent, too this signal volition so force expected inflation too existent involvement rates down. This volition travel only if key banks are credible inwards their actions, i.e., they are viewed equally acting inwards goodness organized religious belief too amongst goodness information too are non gaming the market.

- The minute channel is for the key banking concern to actively come inwards the bond marketplace too purchase or sell bonds, thence affecting the demand for bonds, too involvement rates. This is odd but it is what key banks inwards the USA too the European Union receive got done since 2008 nether the rubric of quantitive easing. For this to receive got a cloth effect on involvement rates, the key banking concern has to last a big plenty buyer of bonds to brand a difference.

Measuring the Fed Effect

Just ahead of the Federal Open Market Committee meetings terminal year, equally debate virtually whether the Fed would ease upward on quantitative easing, I argued that nosotros were over estimating the effect that the Fed had on marketplace laid rates too that piece it has contributed to keeping rates depression for the terminal 6 years, an anemic economic scheme was the existent ground for depression involvement rates. To compute the Fed effect, I chose to rails 2 numbers:

- An intrinsic involvement rate, computed past times adding together the actual inflation each twelvemonth too the existent growth charge per unit of measurement each year, 2 imperfect proxies for expected inflation too the existent involvement rate.

- The ten-year U.S. treasury bond rate at the start of each year, laid past times the bond market, but affected past times expectation setting too bond buying past times the Fed.

The graph below captures both numbers, updated through 2015:

Note how closely the U.S. treasury bond has tracked my imperfect guess of the intrinsic involvement rate, too how depression the intrinsic charge per unit of measurement has become, post-crisis. At the endangerment of repeating myself, the Fed has, at best, had only a marginal impact on involvement rates during the terminal 6 years too it is my guess that rates would receive got stayed depression amongst or without the Fed during this period.

Note how closely the U.S. treasury bond has tracked my imperfect guess of the intrinsic involvement rate, too how depression the intrinsic charge per unit of measurement has become, post-crisis. At the endangerment of repeating myself, the Fed has, at best, had only a marginal impact on involvement rates during the terminal 6 years too it is my guess that rates would receive got stayed depression amongst or without the Fed during this period.

Negative Interest Rates

Turning to the enquiry at hand, is it possible for nominal involvement rates to last negative, based upon fundamentals? The answer is yes, but amongst a caveat. If the preference for electrical flow consumption over time to come consumption dissipates or gets unopen to null too you lot await deflation inwards a currency, you lot could destination upward amongst a negative involvement rate. In fact, that is the mutual thread that runs through the economies (Japan, the Euro Zone, Switzerland) where rates receive got acquire negative.

Now, comes the caveat. If you lot receive got nominal negative involvement rates, why would you lot ever lend money out, since you lot receive got the alternative of precisely asset on to the money equally cash. Historically, that has led many to believe that the flooring on nominal rates should last zero. As rates conk below zero, it is fourth dimension to reexamine that belief. One agency to reconcile negative involvement rates amongst rational conduct is to introduce costs to asset cash and in that location are clearly some to factor in, peculiarly inwards today's economies. The source is that piece the proverbial stuffing cash nether your mattress alternative is thrown some equally a choice, you lot volition growth your exposure to theft too may receive got to invest inwards security measures that are costly. The minute is that in that location are some transactions that are extraordinarily cumbersome to acquire done amongst cash; imagine buying a 1000000 dollar household too counting out the cash for the payment. The Danish, Swiss too Japanese governments are embarking on a grand experiment, perhaps, of how much savers volition last willing to pay for the convenience of staying cashless. In effect, the lower outpouring has shifted below null but in that location is nonetheless one. To those who are convinced that negative involvement rates receive got null to do amongst fundamentals too that they are alone past times key banking concern design, I would fence that the only ground that these key banks receive got been able to force rates below zero, is because existent growth too inflation receive got acquire so depression inwards their economies that the intrinsic charge per unit of measurement was unopen plenty to null to laid out with. There is no run a endangerment that the Brazilian too Indian key banks volition follow suit.

Turning to the enquiry at hand, is it possible for nominal involvement rates to last negative, based upon fundamentals? The answer is yes, but amongst a caveat. If the preference for electrical flow consumption over time to come consumption dissipates or gets unopen to null too you lot await deflation inwards a currency, you lot could destination upward amongst a negative involvement rate. In fact, that is the mutual thread that runs through the economies (Japan, the Euro Zone, Switzerland) where rates receive got acquire negative.

Now, comes the caveat. If you lot receive got nominal negative involvement rates, why would you lot ever lend money out, since you lot receive got the alternative of precisely asset on to the money equally cash. Historically, that has led many to believe that the flooring on nominal rates should last zero. As rates conk below zero, it is fourth dimension to reexamine that belief. One agency to reconcile negative involvement rates amongst rational conduct is to introduce costs to asset cash and in that location are clearly some to factor in, peculiarly inwards today's economies. The source is that piece the proverbial stuffing cash nether your mattress alternative is thrown some equally a choice, you lot volition growth your exposure to theft too may receive got to invest inwards security measures that are costly. The minute is that in that location are some transactions that are extraordinarily cumbersome to acquire done amongst cash; imagine buying a 1000000 dollar household too counting out the cash for the payment. The Danish, Swiss too Japanese governments are embarking on a grand experiment, perhaps, of how much savers volition last willing to pay for the convenience of staying cashless. In effect, the lower outpouring has shifted below null but in that location is nonetheless one. To those who are convinced that negative involvement rates receive got null to do amongst fundamentals too that they are alone past times key banking concern design, I would fence that the only ground that these key banks receive got been able to force rates below zero, is because existent growth too inflation receive got acquire so depression inwards their economies that the intrinsic charge per unit of measurement was unopen plenty to null to laid out with. There is no run a endangerment that the Brazilian too Indian key banks volition follow suit.

Interest Rates, Financial Assets too the Real Economy

When key banks inwards these currencies strongly signal their intent to drive involvement rates to null too below, what could last the motivation? Put simply, it is the belief that lower involvement rates Pb to higher prices for fiscal assets too more existent investment inwards the economy, either through the machinery of "lower" hurdle rates for investments or a weaker currency making businesses to a greater extent than competitive globally. In this key banking heaven, where key banks laid rates too the the world meekly follows, this is what unfolds:

So, why has it non worked? As involvement rates inwards the US, Europe too Nippon receive got tested novel lows each twelvemonth for the terminal few, nosotros receive got non seen an explosion inwards existent investment inwards these countries, too piece stock prices receive got risen, the ascent has had equally much to do amongst higher earnings too cash flows, equally it has to do amongst lower involvement rates. In my view, the fundamental miscalculation that key banks receive got made is inwards assuming that their actions non only acquit upon other pieces of this puzzle but are also read equally signals of the future. In particular, key bankers receive got failed to contain 3 problems: that involvement rates do non ever follow the key banking concern lead, that endangerment premiums on equity too debt may growth equally rates conk downward too that commutation charge per unit of measurement effects are muted past times other key banks acting at the same time. In this reality-based key banking universe, the lowering of rates past times key banks tin give the sack receive got unpredictable too frequently perverse consequences, lowering fiscal asset prices, reducing existent investment too making a currency stronger rather than weaker.

This is all hypothetical, you lot may say, but in that location is evidence that markets receive got acquire much less trusting of key banking too to a greater extent than willing to conk their ain ways. For instance, equally the endangerment complimentary charge per unit of measurement has dropped over the terminal few years, annotation that the expected render for stocks has stayed some 8% during that period, leading to higher too higher equity endangerment premiums.

While bond markets initially did non reckon this phenomenon, terminal twelvemonth default spreads on bonds inwards every ratings even widened, fifty-fifty equally rates dropped. Interestingly, the most recent ECB announcement that they would force the rates they command lower was accompanied past times word that they would come inwards the bond marketplace equally buyers, hoping to continue default spreads down. That is an interesting experiment too I receive got a feeling that it volition non destination well.

So, why has it non worked? As involvement rates inwards the US, Europe too Nippon receive got tested novel lows each twelvemonth for the terminal few, nosotros receive got non seen an explosion inwards existent investment inwards these countries, too piece stock prices receive got risen, the ascent has had equally much to do amongst higher earnings too cash flows, equally it has to do amongst lower involvement rates. In my view, the fundamental miscalculation that key banks receive got made is inwards assuming that their actions non only acquit upon other pieces of this puzzle but are also read equally signals of the future. In particular, key bankers receive got failed to contain 3 problems: that involvement rates do non ever follow the key banking concern lead, that endangerment premiums on equity too debt may growth equally rates conk downward too that commutation charge per unit of measurement effects are muted past times other key banks acting at the same time. In this reality-based key banking universe, the lowering of rates past times key banks tin give the sack receive got unpredictable too frequently perverse consequences, lowering fiscal asset prices, reducing existent investment too making a currency stronger rather than weaker.

This is all hypothetical, you lot may say, but in that location is evidence that markets receive got acquire much less trusting of key banking too to a greater extent than willing to conk their ain ways. For instance, equally the endangerment complimentary charge per unit of measurement has dropped over the terminal few years, annotation that the expected render for stocks has stayed some 8% during that period, leading to higher too higher equity endangerment premiums.

While bond markets initially did non reckon this phenomenon, terminal twelvemonth default spreads on bonds inwards every ratings even widened, fifty-fifty equally rates dropped. Interestingly, the most recent ECB announcement that they would force the rates they command lower was accompanied past times word that they would come inwards the bond marketplace equally buyers, hoping to continue default spreads down. That is an interesting experiment too I receive got a feeling that it volition non destination well.

Dealing amongst Negative Interest Rates

My interests inwards negative involvement rates are primarily inwards the context of valuation too corporate finance. In both arenas, the hurdle rates nosotros purpose to pick investments too value businesses construct off a long term endangerment complimentary charge per unit of measurement equally a base of operations too having that base of operations acquire a negative value is disconcerting to some. There are 2 choices that you lot have:

- Switch currencies: You tin give the sack value Danish companies inwards Euros or U.S. dollars, where long term rates are nonetheless positive (albeit really low). This evades the problem, but you lot tin give the sack run but you lot cannot hide. At some signal inwards time, you lot volition receive got to travel inwards the negative involvement charge per unit of measurement currency.

- Normalize endangerment complimentary rates: This is a exercise that has acquire to a greater extent than prevalent inwards both the U.S. too Europe, where endangerment complimentary rates receive got dropped to historic lows. To compensate, analysts are using the average charge per unit of measurement across long periods equally a normalized endangerment complimentary rate. I receive got problems amongst this approach at 3 levels. The source is that normal is inwards the oculus of the beholder too what you lot telephone phone a normal 10-year T.Bond charge per unit of measurement is to a greater extent than a component of your historic catamenia than scientific judgment. The minute is that given that the endangerment complimentary charge per unit of measurement is where you lot programme to pose your money if you lot don't brand your existent investment, it seems singularly unsafe for this to last a made-up number. The tertiary is that using a normalized endangerment complimentary charge per unit of measurement amongst the high equity endangerment premiums that are prevalent today volition Pb to also high a hurdle rate, since the latter are primarily the termination of depression endangerment complimentary rates.

- Leave the endangerment complimentary charge per unit of measurement negative: So, what if the endangerment complimentary charge per unit of measurement is negative? In valuation, you lot almost never purpose the endangerment complimentary charge per unit of measurement standing alone, but only inwards conjunction amongst a endangerment premium. If you lot tin give the sack update those endangerment premiums, they may really good offset the effect of having a negative endangerment complimentary charge per unit of measurement too yield a cost of equity and/or debt that does non facial expression dissimilar from what it did prior to the negative involvement charge per unit of measurement setting. There is 1 other adjustment that I would make. In stable growth, I receive got been a proponent of using the endangerment complimentary charge per unit of measurement equally your cap on the stable growth rate. With negative endangerment complimentary rates, I would stick amongst this principle, since, equally I noted before inwards this post, negative involvement rates signify economies amongst depression or no existent growth combined amongst deflation too the growth charge per unit of measurement inwards perpetuity for stable companies inwards these economies should last negative for those same reasons.

What Real Negative Interest Rates Signify

When involvement rates of from existence actually modest positive numbers (0.25% or 0.50%) to actually modest negative numbers (-0.25% to -0.50%), the mathematical consequences are modest but I do think that breaching null has consequences too almost all of them are negative.

- The economical destination game: For those who ultimately help virtually existent economical growth too prosperity, negative involvement rates are bad news, since they are incompatible amongst a healthy, growing economy.

- Central banks insanity, impotence too desperation: As I sentinel key bankers preen for the cameras too pig the limelight, I am reminded of the former Definition of insanity equally trying the same affair over too over, expecting a dissimilar outcome. After 6 years of continually trying to lower rates, amongst the expectation of economical growth precisely some the corner, it is fourth dimension for key banks to maybe recognize that this lever is non working. By the same token, the really fact that key banks revert dorsum to the involvement charge per unit of measurement lever, when the evidence suggests that it has non worked, is a sign of desperation, an admission past times key banks that they receive got run out of ideas. That is genuinely scary too maybe explains the ascent inwards endangerment premiums inwards fiscal markets too the unwillingness of companies to brand existent investments.

- Unintended consequences: As involvement rates hitting null too conk lower, in that location volition last some investors, inwards necessitate of fixed income, who volition facial expression inwards unsafe places for that income. Influenza A virus subtype H5N1 modern-day Bernie Madoff would necessitate to offering only 4% inwards this marketplace to attract investors to his fund too equally I sentinel investors chase after yieldcos, MLPs too other high dividend paying entities, I am inclined to believe that is a painful reckoning ahead of us.

- An opening for digital currencies: In a postal service a few years ago, I looked at bitcoin too argued that in that location volition last a digital currency, sooner rather than later, that meets the requirements of trust needed for a currency inwards broad use. The to a greater extent than key bankers inwards conventional currencies play games amongst involvement rates, the greater is the opening for a well-designed digital currency amongst a dependable issuing say-so to dorsum it up.

In the adjacent few weeks, I am for certain that nosotros volition read to a greater extent than word stories virtually key banks professing to last shocked that markets receive got non done their bidding too that economies receive got non revived. I am non for certain whether I should attribute these rantings to the hubris of key bankers or to their blindness to marketplace realities. Either way, I experience less comfortable amongst the notion that key bankers know what they are doing too that nosotros should trust them amongst our economical fates.

YouTube Video

Datasets

Tidak ada komentar:

Posting Komentar