In a serial of posts over the course of educational activity of the lastly year, I argued that yous tin value users in addition to subscribers at businesses, using starting fourth dimension principles inwards valuation, in addition to receive got used the approach to value Uber riders, Amazon Prime members and Spotify & Netflix subscribers. With each iteration, I receive got learned a few things most user value in addition to ways of distinguishing betwixt user bases that tin create substantial value from user bases that non exclusively are incapable of creating value but tin actively destroy it. I was reminded of these principles this week, starting fourth dimension equally I wrote about Walmart's $16 billion bid for 77% of Flipkart, a bargain at to the lowest degree partially motivated past times shopper numbers, in addition to then 1 time to a greater extent than equally I read a news story most MoviePass and the potential demise of its "too proficient to live true" model, in addition to finally equally I tripped over a LimeBike on my walk home.

User Based Value

My endeavor to create a user-based valuation model was triggered past times a comment that I got on a valuation that I had done of Uber most a yr agone on my blog. In that post, I approached Uber, equally I would whatsoever other business, in addition to valued it, based upon aggregated revenues, earnings in addition to cash flows, discounted dorsum at a company-wide cost of capital. I was taken to chore for applying an old-economy valuation approach to a new-economy fellowship in addition to was told that that the companies of today derive their value from customers, users in addition to subscribers. While my initial reply was that yous cannot pay dividends amongst users, I realized that at that spot was a gist truth to the critique in addition to that companies are increasingly edifice their businesses around their members.

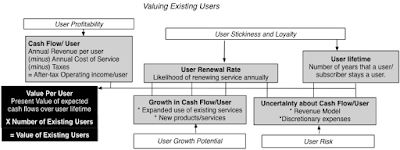

Consequently, I went dorsum to valuation starting fourth dimension principles, where the value of whatsoever property is a business office of its cashflows, growth in addition to risks, in addition to adapted that approach to valuing a user or subscriber:

To acquire from the value of existing users to the value of an entire company, I incorporated the value effect of novel users, bringing inwards the cost of acquiring a novel user into the value:

I applied closure past times consider all corporate costs that are non straight related to users or subscribers inwards a corporate cost drag, a drag because it reduces the value of the business:

Cumulating the value of existing in addition to novel users, in addition to netting out the corporate cost drag yields the value of operating assets, i.e., the same value that yous would derive past times discounting the gratuitous cash flows to the entire describe of piece of employment concern past times its overall cost of capital. You would yet involve to create clean up, past times adding inwards cash, netting out debt in addition to dealing amongst outstanding options, but that procedure is the same inwards both models.

I would hasten to add together that a user-based value model is non a panacea to whatsoever of the valuation challenges that nosotros human face amongst young, user-based companies. In fact, the difficulties amongst obtaining the raw information needed on user renewal rates in addition to acquisition costs tin live so daunting that whatsoever potential advantages that yous obtain past times looking at user-level value tin live drowned out past times noise. It is also worth emphasizing that its user-focus notwithstanding, this model is grounded inwards fundamentals, amongst value coming, equally it e'er does, from cash flows, growth in addition to risk. I am yet learning most this model, but I receive got pose downwards what I receive got learned over the lastly year, when valuing Uber, Amazon Prime in addition to Netflix, into a newspaper that yous tin download, read in addition to critique.

Good, Bad in addition to Indifferent User-based Models

One of the motivations for my user-focused valuation was based upon casual empiricism. In my view, many venture capitalists in addition to world investors are pricing user-based companies on user count, amongst exclusively a few seriously trying to distinguish betwixt good, indifferent in addition to bad user-based models. One of the bonuses of using a user-based model is that it provides a framework for differentiating betwixt corking in addition to mediocre user-based companies.

Drivers of Value

Influenza A virus subtype H5N1 touchstone critique that old-time value investors receive got of user-based companies is that they all lose money, but that is non true. There are user-based companies that brand money, but it is also truthful that the user-based model is yet inwards its infancy in addition to that many user-based companies are young, in addition to thus lose money. That said, at that spot are elements of the cost construction that yous tin await at, to brand judgments on which user-based companies are most probable to grow out of their problems in addition to which ones are simply going to grow their problems.

a. Cost Structure: Most young, user-based companies lose coin but at the adventure of sounding unbalanced, at that spot are proficient ways to lose coin in addition to bad ones, from a value perspective.

- Servicing Existing Users versus New User Acquisition: From a value perspective, it is far ameliorate for a fellowship to live losing money, because it is spending coin trying to acquire novel users, than it is to live losing money, because it costs so much to service existing users. The latter signals a bad describe of piece of employment concern model, at to the lowest degree for the moment, whereas the onetime offers a semblance of hope.

- Fixed versus Variable Costs: For mature companies amongst established describe of piece of employment concern models, it is ameliorate to receive got a to a greater extent than flexible cost construction (with to a greater extent than variable costs in addition to less fixed costs). With money-losing, high-growth companies, the contrary is true, since it is the fixed cost portion that yields economies of scale, equally the fellowship grows.

b. Growth: Repeating a value nostrum, growth is non e'er value-creating in addition to non all growth is created equal.

- Existing versus New Users: Influenza A virus subtype H5N1 user-based model, where yous tin grow cash flows from existing users is to a greater extent than valuable, other things remaining equal, than a user-based model that is subject on adding novel users for growth. The ground is simple. Since a fellowship already has expended resources to acquire existing users, whatsoever added revenue it derives from them is to a greater extent than probable to menses straight to the bottom line. Adding novel users is to a greater extent than expensive, partly because it costs coin to acquire them, but also because novel users may non live equally active or lucrative equally existing ones.

- Cost of New User Acquisition: This is a corollary of the starting fourth dimension proposition, since the value of a novel user is internet of user acquisition costs. Consequently, user-based companies that are to a greater extent than cost-efficient inwards adding novel users volition live worth to a greater extent than than user-based companies that pass considerable amounts on advertisement on marketing, to the same end.

This contrast is best illustrated past times looking at Netflix in addition to Spotify, both subscriber-based companies, but amongst real dissimilar models for paying for content. Netflix pays for content equally a fixed cost, in addition to derives economies of scale, when it adds fresh subscribers, whereas Spotify pays for content, based upon how much subscribers hear to songs, making it a variable in addition to existing user based cost. As a result, Netflix derives much higher value from both existing in addition to novel subscribers:

| Netflix | Spotify | |

|---|---|---|

| Number of Subscribers | 117.6 | 71 |

| Annual Revenue/Subscriber | $ 113.16 | $ 77.63 |

| Subscriber Service Expenses (as %) | 18.90% | 79.24% |

| CAGR inwards subscriber count | 223.93% | 369.86% |

| Value per Existing Subscriber | $ 508.89 | $ 108.65 |

| Cost of acquiring New Subscriber | $ 111.01 | $ 27.30 |

| Value per New Subscriber | $ 397.88 | $ 81.35 |

| Value of all Existing Subscribers | $ 59,845.86 | $ 7,714.28 |

| + Value of all New Subscribers | $ 137,276.49 | $ 20,764.56 |

| - Corporate Cost Drag | $ 111,251.70 | $ 13,139.75 |

| =Value of Operating Assets | $ 85,870.65 | $ 15,339.10 |

c. Revenue Models: There are 3 user-based models, the starting fourth dimension is the subscription-based model (that Netflix uses), the 2nd is the advertising-based model (that Yelp uses) in addition to the tertiary is a transaction-based model (that Uber uses). There are companies that purpose hybrid versions, amongst Amazon Prime (membership fees in addition to incremental sales) in addition to Spotify (Subscription plus Advertising) beingness proficient examples. Each model comes amongst its pluses in addition to minuses.

- Subscription models tend to live stickier (making revenues to a greater extent than predictable) but they offering less upside potential (it is hard to grow subscription fees at high rates).

- Advertising models scale upward faster, since they require picayune inwards working capital missive of the alphabet investment in addition to adding novel users is easier (since they free), but revenues are heavily driven past times user intensity (how much fourth dimension yous tin acquire users to remain inwards your ecosystem) in addition to exclusive information (collected inwards the course of educational activity of usage).

- Transaction models are the riskiest, since they require users to purpose your production or service, but they also offering the most upside, since your upside is less constrained. Amazon Prime's value, inwards my view, does non stalk primarily from the subscription revenues of $99/year but from Amazon's capacity to sell Prime members to a greater extent than products in addition to services.

While no model dominates, picking the incorrect revenue model tin chop-chop handicap a business. For instance, using a subscription-based model for a transaction business, where usage varies widely across users, tin termination inwards self-selection, where the most intense users select the subscription-based model to relieve money, in addition to less intense users remain amongst a transaction-based model.

Differentiating across User-based Models

With the user-based framework inwards place, nosotros tin start distinguishing betwixt user-based companies. Using existing user value in addition to novel client acquisition costs equally the dimensions, nosotros tin derive a matrix of companies that perish from user-value stars to user-value dogs.

While the combination of high user value amongst depression user acquisition costs may audio similar a piping dream, it is what network benefits in addition to large data, if they exist, hope to deliver.

- Network benefits refer to the possibility that equally yous grow bigger, it becomes easier for yous to acquire fifty-fifty bigger, making it less costly to acquire novel users. That is the hope of ride sharing, for instance, where equally a fellowship gets a larger portion of a ride sharing market, both drivers in addition to customers are to a greater extent than probable to switch to it, the former, because they acquire to a greater extent than customers in addition to the latter, because they abide by rides to a greater extent than quickly.

- Big data, inwards a value framework, offers user-based companies an advantage, since what yous acquire most your users tin live used to either sell them to a greater extent than products or services (if yous are a transaction-based company), accuse them higher premiums (if yous are subscription-based) or direct advertising to a greater extent than effectively (if advertising-based).

Many user-based companies aspire to receive got network benefits in addition to to purpose information well, but exclusively a few succeed.

The Pricing Game

As I await at user-based companies, some of which are beingness priced at billions of dollars, I am struck past times how few of them are built to live long term businesses in addition to how many of them are beingness priced on user numbers in addition to buzz words. Using the framework from the lastly section, I would similar to develop some mutual features that bad user-businesses seems to portion inwards mutual in addition to purpose 1 high profile examples, MoviePass , to brand my case.

Mediocre User-based Companies

Given that so many immature companies marketplace themselves, based upon user in addition to subscriber numbers, in addition to that some of them tin perish valuable companies, are at that spot signs that yous tin await for that separate the proficient from the mediocre companies? I intend so, in addition to hither are a few cherry flags:

- All most users, all the time: If the entire sales pitch that a fellowship makes to investors is most its user or subscriber numbers, rather than its operating results (revenues in addition to operating profits/losses), it is a unsafe sign. While large user numbers are a positive, it requires a describe of piece of employment concern model to convert these users into revenues in addition to profits, in addition to that describe of piece of employment concern model volition non develop spontaneously. Companies that practise non operate on developing feasible describe of piece of employment concern models perish bankrupt amongst lots of users.

- Opacity most user data: It is ironic that companies that marketplace themselves to investors, based upon user numbers, are oft opaque most key dimensions on users, including renewal (churn) rates, user conduct in addition to side costs related to users. The companies that are most opaque are oft the ones that receive got user models that are non sustainable.

- Bad describe of piece of employment concern models: If having no describe of piece of employment concern model to convert users to operating results is a bad sign, it is an fifty-fifty worse sign when yous receive got a describe of piece of employment concern model that is designed to deliver losses, non exclusively inwards its electrical current form, but amongst no lite at the terminate of the tunnel. That is ordinarily the upshot of having losses that scale upward equally the fellowship gets bigger, because at that spot are economies of scale.

- Loose utter most data: The autumn dorsum for many user based companies that cannot defend their describe of piece of employment concern models is that they volition abide by a agency to purpose the information that they volition collect from their users to brand coin inwards the hereafter (from targeted advertising or additional products in addition to services), without whatsoever serious endeavor to explicate why the information volition give them an edge.

- And externalities: Many user based companies fence that their "innovative" twists on an existing describe of piece of employment concern volition both expand in addition to modify the business, leading to benefits for other players inwards that business, who, inwards turn, volition portion their benefits amongst the user based companies.

MoviePass: Too Good to live True?

If yous subscribe to MoviePass, for a monthly subscription of $10, yous acquire to sentry 1 theatrical movie, every day, for the entire month. Given that the average toll of a theatre ticket inwards the US is $9, this sounds similar an insanely proficient deal, in addition to for an avid motion painting goer, it is, in addition to the service had ii 1 G k subscribers inwards May 2018. MoviePass, though, pays the theaters for the tickets, creating a model that is to a greater extent than designed to drive it into bankruptcy than to deliver profits.

When confronted past times the insanity of the describe of piece of employment concern model, Mitch Lowe, the CEO of MoviePass, argued that afterwards an initial burst, where subscribers would encounter iv or 5 movies a month, Valuing Uber Riders Valuing Amazon Prime Members Valuing Spotify Subscribers Valuing Netflix Subscribers

|

| MoviePass Economics |