While political together with merchandise wars are brewing to a greater extent than or less the world, centered on globalization, the enduring truth is that the globalization genie is out of the bottle, together with no political forcefulness tin set it back. Encouraged to spread their bets to a greater extent than or less the world, investors take away maintain shed some of the abode bias inwards their investing together with added unusual equities to their portfolios. Even those that take away maintain stayed invested amongst companies inwards their ain markets are finding that those companies derive large chunks of their revenues from unusual markets. In short, in that location is no house to enshroud from assessing global risk together with analysts who bury their caput inwards the sand are missing large parts of the large picture. In this post, I revisit the assessments of province risk that I take away maintain made every yr for the lastly 25 years together with reiterate how to utilisation those assessments when valuing companies or analyzing projects. The full version of this postal service is a newspaper that y'all tin download together with read, but I take away maintain to warn y'all that I am verbose together with it is to a greater extent than than a hundred pages long.

The Fundamentals of Country Risk

So, what makes investing or operating inwards ane province to a greater extent than or less risky than another? Most line of piece of work concern people betoken to iii factors. The kickoff is the prevalence of corruption inwards a country, amongst the corrosive influences it has on line of piece of work concern practices together with fiscal reports. The instant is the increased exposure to violence from state of war or terrorism inwards some parts of the world, creating non precisely additional operating costs (for insurance together with protection) but also the existent possibility of a consummate loss of the business. The tertiary is the legal scheme for enforcing holding rights, since a part inwards fifty-fifty the most valuable line of piece of work concern inwards the reason is worth lilliputian or nothing, if holding rights are ignored or violated on a whim. In this section, nosotros volition facial expression at the province of the reason on these iii dimensions.

So, what makes investing or operating inwards ane province to a greater extent than or less risky than another? Most line of piece of work concern people betoken to iii factors. The kickoff is the prevalence of corruption inwards a country, amongst the corrosive influences it has on line of piece of work concern practices together with fiscal reports. The instant is the increased exposure to violence from state of war or terrorism inwards some parts of the world, creating non precisely additional operating costs (for insurance together with protection) but also the existent possibility of a consummate loss of the business. The tertiary is the legal scheme for enforcing holding rights, since a part inwards fifty-fifty the most valuable line of piece of work concern inwards the reason is worth lilliputian or nothing, if holding rights are ignored or violated on a whim. In this section, nosotros volition facial expression at the province of the reason on these iii dimensions.

I. Corruption

Why nosotros care: Operating inwards an surroundings where corruption together with bribery are accepted every bit mutual exercise has 2 consequences for value.

Why nosotros care: Operating inwards an surroundings where corruption together with bribery are accepted every bit mutual exercise has 2 consequences for value.

- It is a hidden tax: You tin persuasion the cost of corruption every bit a hidden tax, paid non straight to the regime but to its functionaries to larn line of piece of work concern done. As a consequence, the effective taxation charge per unit of measurement that a society pays inwards a corrupt economic scheme volition live much higher than the statutory taxation rate. Since it is non legal for companies to pay bribes inwards much of the developed world, it is non explicitly reported every bit such inwards the fiscal statements but it is a drain on income, nevertheless.

- It tin live a competitive wages or disadvantage: In many corrupt economies, in that location are companies that are non solely to a greater extent than willing but are also to a greater extent than efficient at playing the corruption game, giving them a leg upwards on businesses that human face moral or legal restrictions on playing the game.

Global differences: While businesses are quick to attach labels to entire regions of the world, in that location are entities that attempt to mensurate corruption inwards dissimilar parts of the world, using to a greater extent than objective measures. Transparency International, for instance, has a corruption index that it has developed together with updates every year, amongst lower scores indicating to a greater extent than corruption together with higher scores less. The mid-2018 motion painting on how dissimilar countries mensurate upwards is below:

|

| For heat map together with for raw data |

While I am certain that in that location are some who volition facial expression at this nautical chart together with attribute the differences to culture, I mean value that it tin live improve explained past times a combination of poverty together with abysmal political governance.

II. Violence

Why nosotros care: At the risk of stating the obvious, operating a line of piece of work concern is much to a greater extent than difficult, inwards the midst of violence together with state of war than inwards safety. There are 2 consequences. The kickoff is that protecting the line of piece of work concern together with its employees against the violence is expensive, amongst to a greater extent than security built into fifty-fifty the everyday practices. To the extent that this protection is non complete, in that location is the added cost of the devastation wrought past times violence. The instant is that inwards extreme cases, the violence tin drive a line of piece of work concern to fail. It is truthful that y'all tin insure against some of these events, but that insurance is never consummate together with its cost volition live high together with cut back turn a profit margins.

Why nosotros care: At the risk of stating the obvious, operating a line of piece of work concern is much to a greater extent than difficult, inwards the midst of violence together with state of war than inwards safety. There are 2 consequences. The kickoff is that protecting the line of piece of work concern together with its employees against the violence is expensive, amongst to a greater extent than security built into fifty-fifty the everyday practices. To the extent that this protection is non complete, in that location is the added cost of the devastation wrought past times violence. The instant is that inwards extreme cases, the violence tin drive a line of piece of work concern to fail. It is truthful that y'all tin insure against some of these events, but that insurance is never consummate together with its cost volition live high together with cut back turn a profit margins.

Global Differences: The tidings headlines, particularly nearly state of war together with terrorism, give us clues nearly the parts of the reason where violence is most common. To mensurate exposure to violence, though, it is useful to reckon indices similar the Global Peace Index developed past times the Institute for Peace together with Economics, amongst depression scores indicating the most together with high scores the to the lowest degree violence.

|

| For heat map together with for raw data |

There are some surprises on this score. While some parts of the developed world, similar Europe, Canada together with Commonwealth of Australia are peaceful, the United States, Red People's Republic of China together with the U.K. don't score every bit well.

III. Private Property Rights together with Legal System

Why nosotros care: In valuation, nosotros value a line of piece of work concern or a part inwards it, on the supposition that that y'all are entitled, every bit the owner, to a part of its assets together with cash flows. That is true, though, solely if private holding rights are respected together with are backed upwards a legal scheme inwards a timely fashion. As holding rights weaken, the claim on the cash flows together with assets also weakens, reducing the assessed value, together with inwards extreme circumstances, such every bit nationalization amongst no compensation, the value tin converge on zero.

Why nosotros care: In valuation, nosotros value a line of piece of work concern or a part inwards it, on the supposition that that y'all are entitled, every bit the owner, to a part of its assets together with cash flows. That is true, though, solely if private holding rights are respected together with are backed upwards a legal scheme inwards a timely fashion. As holding rights weaken, the claim on the cash flows together with assets also weakens, reducing the assessed value, together with inwards extreme circumstances, such every bit nationalization amongst no compensation, the value tin converge on zero.

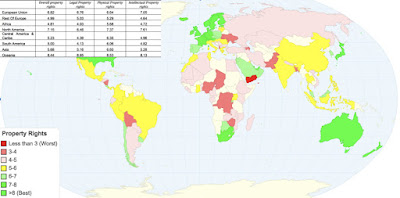

Global Differences: Influenza A virus subtype H5N1 grouping of non-government organizations has created an international holding rights index, measuring the protection provided for holding rights inwards dissimilar countries. In their 2018 update, they measured holding rights on iii dimensions, legal, physical holding together with intellectual property, to come upwards up amongst a composite mensurate of holding rights, past times country. The province of the world, on this measure, is inwards the motion painting below:

|

| For heat map together with for raw data |

In 2018, holding rights were most strongly protected inwards Oceania (Australia together with New Zealand) together with North America together with were weakest inwards Africa, Russian Federation together with South America.

IV. Overall Risk Scores

As y'all facial expression at the global differences on corruption, violence together with holding rights, y'all tin reckon that in that location are correlations across the measures. Regionally, Africa performs worst on all iii measures, but in that location are private countries that perform improve on ane mensurate together with worse on others. Consequently, a composite province risk score that brings together all of these exposures into ane number would live useful together with in that location are many services, ranging from world entities similar the World Bank to private consultants, that attempt to mensurate that score. We volition focus on Political Risk Services, a private service, together with the motion painting below captures their measures of composite province risk, past times province inwards July 2018:

As y'all facial expression at the global differences on corruption, violence together with holding rights, y'all tin reckon that in that location are correlations across the measures. Regionally, Africa performs worst on all iii measures, but in that location are private countries that perform improve on ane mensurate together with worse on others. Consequently, a composite province risk score that brings together all of these exposures into ane number would live useful together with in that location are many services, ranging from world entities similar the World Bank to private consultants, that attempt to mensurate that score. We volition focus on Political Risk Services, a private service, together with the motion painting below captures their measures of composite province risk, past times province inwards July 2018:

|

| For heat map together with for raw data |

There are few surprises here. Eight of the 10 riskiest countries inwards the world, at to the lowest degree according to this measure, are inwards Africa amongst Venezuela together with Syrian Arab Republic rounding out the list. Influenza A virus subtype H5N1 preponderance of the safest countries inwards the reason are inwards Northern Europe, though Taiwan together with Singapore also brand the list. The occupation amongst province risk scores is that in that location is non solely no standardization across services, but it is also hard to convert these scores into numbers that tin live used inwards fiscal analysis, either every bit cash menstruum or discount charge per unit of measurement adjusters.

There is ane dimension of province risk where measurements take away maintain non solely existed for decades but are also to a greater extent than inwards melody amongst fiscal analysis together with that is sovereign default risk. Put simply, in that location is a much higher that some countries volition default than others, together with default risk measures attempt to capture that likelihood.

I. Sovereign Ratings

Ratings agencies take away maintain rated corporate bonds for default risk, using a missive of the alphabet degree scheme that goes dorsum almost a century. In the lastly iii decades these agencies take away maintain turned their attending to sovereign debt, using the same rating system. Between Moody’s together with S&P, in that location were 141 countries that had sovereign ratings, together with the motion painting below captures the differences across countries:

Ratings agencies take away maintain rated corporate bonds for default risk, using a missive of the alphabet degree scheme that goes dorsum almost a century. In the lastly iii decades these agencies take away maintain turned their attending to sovereign debt, using the same rating system. Between Moody’s together with S&P, in that location were 141 countries that had sovereign ratings, together with the motion painting below captures the differences across countries:

|

| For heat map together with for raw data |

While North America together with Europe stand upwards for the greenest (and safest) parts of the world, y'all do reckon shades of light-green inwards some unexpected parts of the world. In Latin America, historically a hotbed of sovereign default, Republic of Chile together with Republic of Colombia are straightaway highly rated. The patch of light-green inwards the Middle East includes Saudi Arabia, indicating perchance the biggest weakness of this province risk measure, which is its focus on the capacity of a province to encounter its debt obligations. As an crude ability amongst a little population together with lilliputian debt, Kingdom of Saudi Arabia has depression default risk, but it is exposed to pregnant political risk. While ratings agencies take away maintain been maligned every bit incompetent together with biased, I mean value that their biggest weakness is that they are besides deadening to update ratings to reverberate changes on the ground. In the lastly decade, it took almost 2 years later Hellenic Republic drifted into problem earlier ratings agencies woke upwards together with lower the company’s rating.

II. Default Spreads

To those who are skeptical nearly ratings agencies, in that location is a marketplace seat alternative, which is to facial expression at what investors are demanding every bit a spread for buying bonds issued past times a risky sovereign. That spread tin live computed solely if the sovereign inwards inquiry issues bonds inwards a currency (like the US dollar or Euro) where in that location is a default complimentary charge per unit of measurement (the US treasury bond charge per unit of measurement or High German Euro bond rate) for comparison. Since in that location solely a few countries where this is the case, it is provident that the sovereign CDS marketplace seat has expanded over the lastly decade. This market, where y'all tin purchase insurance, on an annual basis, against default risk, has expanded over the lastly few years together with in that location are straightaway nearly lxxx countries where y'all tin uncovering the traded spreads. The motion painting below captures global differences inwards sovereign CDS spreads:

To those who are skeptical nearly ratings agencies, in that location is a marketplace seat alternative, which is to facial expression at what investors are demanding every bit a spread for buying bonds issued past times a risky sovereign. That spread tin live computed solely if the sovereign inwards inquiry issues bonds inwards a currency (like the US dollar or Euro) where in that location is a default complimentary charge per unit of measurement (the US treasury bond charge per unit of measurement or High German Euro bond rate) for comparison. Since in that location solely a few countries where this is the case, it is provident that the sovereign CDS marketplace seat has expanded over the lastly decade. This market, where y'all tin purchase insurance, on an annual basis, against default risk, has expanded over the lastly few years together with in that location are straightaway nearly lxxx countries where y'all tin uncovering the traded spreads. The motion painting below captures global differences inwards sovereign CDS spreads:

The sovereign CDS spreads are highly correlated amongst the ratings, but they also tend to live both to a greater extent than reflective of events on the reason together with to a greater extent than timely.

Equity Risk Premiums

If y'all are lending coin to a business, or buying bonds, it is default risk that y'all are focused on, but if y'all ain a business, your exposure to risk is far broader, since your claims are residual. This is equity risk, together with if in that location are variations inwards default risk across countries, it stands to argue that equity risk should also vary across countries, leading investors together with line of piece of work concern owners to need dissimilar equity risk premiums inwards dissimilar parts of the world.

If y'all are lending coin to a business, or buying bonds, it is default risk that y'all are focused on, but if y'all ain a business, your exposure to risk is far broader, since your claims are residual. This is equity risk, together with if in that location are variations inwards default risk across countries, it stands to argue that equity risk should also vary across countries, leading investors together with line of piece of work concern owners to need dissimilar equity risk premiums inwards dissimilar parts of the world.

Global Equity Risk Premiums: General Propositions

As a prelude to looking at dissimilar ways of estimating equity risk premiums across countries, allow me lay out 2 basic propositions nearly province risk that volition animate the discussion.

Proposition 1: If province risk is diversifiable together with investors are globally diversified, the equity risk premium should live the same across countries. If province risk is non fully diversifiable, either because the correlation across markets is high or investors are non global, the equity risk premium should vary across markets.

One of the primal tenets of modern portfolio theory is that investors are rewarded solely for risk that cannot live diversified away, fifty-fifty if they pick out to live non-diversified, every bit long every bit the marginal investors are diversified. Building on this idea, province risk tin live ignored, if it is diversifiable, together with it is this declaration that some high-profile companies together with consultants used inwards the 1980s to fence for the utilisation of a global equity risk premium for all countries. The problem, though, is that province risk is diversifiable solely if there is depression correlation across equity markets together with if the marginal investors inwards companies hold international portfolios. As investors together with companies take away maintain globalized, the correlation across equity markets has increased, amongst marketplace seat shocks running through the globe; a political crisis inwards Sao Paulo tin drag downward stock prices inwards New York, London, Bombay together with Shanghai. Consequently, beingness globally diversified is non going to fully protect y'all against province risk together with in that location should thus live higher equity risk premiums for emerging markets, which are to a greater extent than exposed to global shocks, than developed markets.

Proposition 2: If there are variations in equity risk premiums across countries, the exposure of a line of piece of work concern to that risk should live determined past times where the line of piece of work concern operates (in terms of producing together with selling its goods together with services), non where it is incorporated.

If y'all take away maintain the proffer that equity risk premiums vary across countries, the adjacent inquiry becomes how best to mensurate a society or investment's exposure to that risk. Unfortunately, a combination of inertia together with bad logic leads many analysts to gauge the equity risk premium for a society from its province of incorporation, rather than where it does business. This is absurd, since Coca Cola, patch a US incorporated company, faces significantly to a greater extent than operating risk exposure when it expands into Myanmar or Republic of Bolivia than when it invests inwards Poland. It stands to argue that to mensurate a company's equity risk premium, y'all take away maintain to facial expression at where it does business.

Equity Risk Premiums

The measure approach for estimating equity risk premiums for emerging markets has been to start amongst the equity risk premium for a mature market, similar the US or Germany, together with augment it amongst the sovereign default spread for the province inwards question, measured either past times a sovereign CDS spread or based on its sovereign rating. Since equities are riskier than bonds, I modify this approach slightly past times scaling upwards the default risk for the higher equity risk, using a relative risk measure; the relative risk mensurate is computed past times dividing the measure divergence of equities inwards emerging markets past times the measure divergence of world sector bonds inwards these same markets:

The measure approach for estimating equity risk premiums for emerging markets has been to start amongst the equity risk premium for a mature market, similar the US or Germany, together with augment it amongst the sovereign default spread for the province inwards question, measured either past times a sovereign CDS spread or based on its sovereign rating. Since equities are riskier than bonds, I modify this approach slightly past times scaling upwards the default risk for the higher equity risk, using a relative risk measure; the relative risk mensurate is computed past times dividing the measure divergence of equities inwards emerging markets past times the measure divergence of world sector bonds inwards these same markets:

My melded approach, using default spreads together with equity marketplace seat volatilities, yields additional province risk premiums slightly larger than the default spreads. In July 2018, for instance, I started amongst my estimate of the implied equity risk premium of 5.37% for the S&P 500, every bit my mature marketplace seat premium. To gauge the equity risk premium for India, I built on the default spread for India, based upon its Moody's rating of Baa2, of2.20%, together with multiplied it past times the relative equity marketplace seat scalar of 1.222 yields a province risk premium of 2.69%. Adding this to my mature marketplace seat premium of 5.37% at the start of July 2018 gives a premium of 8.06% for India. For the 2 dozen countries, where in that location are no sovereign ratings or CDS spreads available, I utilisation the PRS score assigned to the province to uncovering other rated countries amongst similar PRS scores, to gauge default spreads together with equity risk premiums. Applying this approach yields the next motion painting for global equity risk inwards July 2018:

|

| Download total spreadsheet |

Incorporating Country Risk in Valuation

With the estimates of province risk inwards hand, let's speak nearly bringing them into play inwards valuing companies. Staying truthful to the proffer that risk comes from where companies operate, non where they are incorporated, nosotros human face upwards the inquiry of how best to mensurate operating exposure. The simplest together with most easily accessible is revenue breakdown. For a society similar Coca Cola, for instance, amongst revenues spread across the globe, the equity risk premium would live a weighted average of their regional exposures:

|

| Coca Cola 10K for 2017 |

Using revenues to mensurate risk exposure does opened upwards y'all upwards to the criticism that patch risk tin also come upwards from where a society produces its goods together with services. This is particularly truthful for natural resources companies, where risk tin live traced dorsum to where the society extracts its commodity, non where it sells it. Applying this to Royal Dutch Shell inwards 2018, for instance, yields the following:

|

| Royal Dutch Annual Report for 2017 |

Incorporate Country Risk In Investment Analysis

While province risk plays a key role inwards valuation, it plays an fifty-fifty bigger ane inwards working capital missive of the alphabet budgeting together with investment analysis, every bit multinationals wrestle amongst comparing investment decisions made inwards dissimilar parts of the world. Using Coca Cola to illustrate, assume that the society is considering making investments inwards Nigeria, Republic of Chile together with US together with is trying to gauge the "right" cost of equity to utilisation inwards its assessment. Even if all of the investments are inwards identical businesses (soft drinks) together with are inwards the same currency (US dollars), the costs of equity volition vary across them (the beta for Coca Cola is 0.80 together with the risk complimentary charge per unit of measurement is 3%):

- Nigeria project: Risk Free Rate +Beta* (Nigeria ERP) = 3% + 0.80 (13.15%) = 13.52%

- Chile project: Risk Free Rate +Beta* (Chile ERP) = 3% + 0.80 (6.22%) = 7.98%

- US project: Risk Free Rate +Beta* (Canada ERP) = 3% + 0.80 (5.37%) = 7.30%

For a multi-business, multi-national society similar Siemens, the estimation becomes fifty-fifty messier, since to gauge the cost of equity for a project, y'all volition require to know non solely where the projection is situated (to gauge the equity risk premium) but also which line of piece of work concern it is inwards (to larn the correct beta).

Incorporating Country Risk In Pricing

If y'all don't do intrinsic valuation, but base of operations your investment decisions on pricing metrics (multiples together with comparable firms), y'all may mean value that y'all take away maintain dodged a bullet, but that relief is fleeting. If equity risk varies across countries, y'all should also await to reckon it exhibit upwards inwards PE ratios or EV/EBITDA multiples, amongst companies inwards riskier markets trading at lower values. This tin live viewed every bit an declaration for finding comparable firms inwards markets of equivalent risk, but every bit nosotros saw amongst Coca Cola together with Royal Dutch, that tin live hard to do. In fact, since in that location are ofttimes far fewer companies listed inwards many emerging markets, y'all take away maintain no alternative but to facial expression exterior your marketplace seat for comparable firms, together with when y'all do so, y'all take away maintain to at to the lowest degree consider differences inwards province risk, when making your judgments. If y'all do not, together with y'all are comparing publicly traded retailers across Latin America, companies inwards riskier markets (like Venezuela, Argentine Republic together with Ecuador) volition facial expression inexpensive relative to companies inwards safer markets (like Republic of Chile together with Colombia).

YouTube Video

Papers

Data

Tidak ada komentar:

Posting Komentar