In a yr total of high-profile IPOs, WeWork takes middle phase every bit it moves towards its offering date, offering a fascinating insight into corporate narratives, how as well as why they acquire credibility (and value) as well as how rapidly they tin lose them, if markets lose faith. When the WeWork IPO was start rumored, at that spot was beak of the companionship existence priced at $60 billion or more, but the longer investors remove hold had a adventure to aspect at the prospectus, the less enthusiastic they seem to remove hold travel almost the company, amongst a news story today reporting that the companionship was looking at a drastically discounted value of $20 billion, which would create Softbank, the biggest (and most recent) VC investor inwards WeWork, a large loser on the IPO. Before I laid my thoughts downward on WeWork, I volition confess that I remove hold never liked the company, partly because I don't trust CEOs who seem to a greater extent than intent on delivering life lessons for the remainder of us, than on talking almost the businesses they run, as well as partly because of the trail it has left of obfuscation as well as opaqueness. That said, I don't believe inwards writing hitting pieces on companies as well as I volition curvature over backwards to give WeWork the do goodness of the doubt, every bit I wrestle non only amongst its basic occupation organization model but too amongst converting that model into a story as well as numbers.

The WeWork Business Model: Influenza A virus subtype H5N1 Leveraged Bet on Flexibility

The WeWork occupation organization model is neither new, nor peculiarly unique inwards its basic form, though access to uppercase as well as scaling ambitions remove hold pose that model on steroids. That said, most traditional existent estate companies that remove hold tried the WeWork occupation organization model historically remove hold abandoned it, for micro as well as macro reasons, as well as the exam of the WeWork model is whether the advantages it brings to the table, as well as it does convey some, tin assist it succeed, where others remove hold not.

The Business Model

Most businesses demand constituent infinite as well as the means inwards which that constituent infinite is created as well as provided has followed a criterion script for decades. The possessor of an constituent building, who has by as well as large acquired the edifice amongst pregnant debt, rents the edifice to businesses that demand constituent space, as well as uses the rent payments received to comprehend involvement expenses on the debt, every bit good every bit the expenses of operating the building. As economies weaken, the demand for constituent infinite contracts, as well as the resulting driblet inwards occupancy rates inwards constituent buildings exposes the possessor to risk. Prudent existent estate operators travail to purchase buildings when existent estate prices are low, as well as sign upwardly credit worthy tenants amongst long term leases when rental rates are high, thus edifice a profitability buffer to protect themselves against downturns, when they do come. Even amongst added prudence, commercial existent estate has ever been a smash as well as bust occupation organization as well as fifty-fifty the most successful existent estate developers remove hold been both billionaires as well as bankrupt (at to the lowest degree on paper), at dissimilar points of their lives.

The WeWork occupation organization model puts a twist on traditional existent estate. Like the conventional model, it starts past times identifying an attractive constituent property, commonly inwards a metropolis where constituent infinite is tight as well as immature businesses are plentiful. Rather than buying the building, WeWork leases the edifice amongst a long term lease, as well as having leased it, it spends pregnant amounts upgrading the edifice to create it a desirable constituent infinite for the Gen-X as well as Gen-Y workers, brought upwardly to believe inwards the tech companionship paradigm of a cool constituent space. Having renovated the building, WeWork as well as then offers constituent infinite inwards little units (you tin rent only ane desk or a few) as well as on brusque term contracts (as brusque every bit a month). For a given property, if things travel according to plan, every bit the edifice gets occupied, the excess of rental income (over the lease payment) is used to comprehend the renovation costs, as well as in ane lawsuit those costs acquire covered, the economies of scale boot in, generating profits for the company. The steps inwards the WeWork occupation organization model are captured inwards the pic below:

If y'all purchase into the company’s spin, every bit presented inwards its prospectus, the strengths it brings to each phase inwards the procedure are what sets it apart, allowing it to win, where others remove hold failed before. In fact, the companionship is explicitly laying the foundations for this declaration amongst ii graphs inwards its prospectus, ane of which maps out its fourth dimension frame from signing to filling a location as well as the other which presents a picture, albeit a petty skewed, of the profitability of each location, in ane lawsuit stable.

|

| Prospectus: Pages |

Note that all nosotros remove hold is the company's discussion on the timing as well as its Definition of contribution margin plays fast as well as loose amongst operating expenses. To illustrate how the WeWorks model works, consider 600 B Street inwards San Diego, which is an constituent edifice that WeWork acquired, renovated as well as opened inwards 2017:

In 2019, WeWork claimed that the edifice was mostly occupied, which should hateful that the renovation costs are existence recouped, but since the companionship does non reveal per-building numbers, it is impossible to tell what the company's financials are only on this building.

The Model Trade off

The model's allure is built on 3 factors. The start is the WeWork look, amongst opened upwardly operate spaces, cool lighting as well as lots of extras, that the companionship has worked on edifice over its lifetime as well as presumably is able to duplicate inwards a novel building, amongst cost savings as well as quickly. The 2d is the WeWork community, where the companionship supplements its cosmetic features amongst add-on services that arrive at from occupation organization networking to consulting services as well as seminars. The 3rd is its offering of flexibility to businesses, especially valuable at immature companies that human face uncertain futures but increasing becoming so fifty-fifty at established companies that are experimenting amongst alternate operate structures. Presumably, these businesses volition live willing to pay extra for the flexibility as well as WeWork tin capture the surplus. The model's weakness lies inwards a mismatch that is at the pump of the occupation organization model, where WeWork has locked itself into making the renovation costs upwardly front end as well as the lease payments for many years into the future, but its rental revenues volition ebb as well as flow, depending upon the the world of the economy. In fact, the numbers inwards WeWork’s ain prospectus give away the extent of this mismatch, amongst lease commitments showing an average duration inwards excess of 10 years, whereas its renters are locked into contracts that average almost a yr inwards duration, which I obtained past times dividing the revenue backlog past times the revenue run rate. This mismatch is non unique to WeWork. You tin struggle that hotels remove hold ever faced this problem, every bit do the owners of floor buildings, but WeWork is peculiarly exposed for iv reasons:

- Own versus lease: There is an declaration to live made that owning a belongings as well as leasing it is less risky than leasing the belongings as well as and then sub-leasing it, as well as it is non because buying a belongings does non give ascent to fixed costs. It does, inwards the shape of the debt that y'all accept on, when y'all purchase the property, but borrowing & buying comes amongst ii advantages over leasing. First, when buying a property, y'all tin create upwardly one's hear the proportion of value that comes from equity, allowing y'all to trim down your fiscal leverage, if y'all experience over exposed. Second, if the belongings value of a edifice rises after y'all remove hold bought it, the equity element of value builds upwardly implicitly, reducing effective leverage, though if belongings values drop, the opposite volition occur.

- Explosive growth: As nosotros volition reckon inwards the side past times side section, WeWork does non only remove hold a mismatched model, it is ane that has scaled upwardly at a charge per unit of measurement that has never been seen inwards the existent estate business, going from ane belongings inwards 2010 to to a greater extent than than 500 locations inwards 2019, adding to a greater extent than than 100,000 foursquare feet of constituent infinite each month. This global growth has given ascent to gigantic lease commitments, which combined amongst its operating losses inwards 2018, create it peculiarly exposed.

- Tenant Self-selection: By specifically targeting immature companies as well as businesses that value flexibility, the companionship has created a selection bias, where its customers are the ones most likely to line dorsum on their constituent rentals, if at that spot is a downturn.

- Lack of cost discipline: Companies that remove hold historically been exposed to the mismatch occupation remove hold learned that, to survive, they demand to remove hold cost discipline, keeping fixed cost commitments depression as well as adjusting rapidly to changes inwards the environment. While it is possible that WeWork is secretly next these practices, their prospectus seems to propose that they are oblivious to their peril exposure.

It is worth noting that the WeWork occupation organization model has been tried inwards existent estate before, amongst calamitous results. As Sam Zell, a billionaire amongst deep roots inwards existent estate, noted on CNBC, on September 4, 2019, non only did he lose money investing inwards a occupation organization model similar this ane inwards 1956, but every companionship inwards the constituent infinite subletting infinite that existed as well as then went out of business.

The Back Story

The Back Story

To sympathize where WeWork stands today, I started amongst the prospectus that the companionship filed on August 14. While this filing may live updated, it provides a footing for whatever story telling or valuation of the company.

1. Operations

The financials reported inwards a companionship clearly pigment a pic of growth inwards the company, every bit tin live seen on almost every operating dimension (cities, locations, tenants, revenues).

1. Operations

The financials reported inwards a companionship clearly pigment a pic of growth inwards the company, every bit tin live seen on almost every operating dimension (cities, locations, tenants, revenues).

While the growth represents the proficient tidings constituent of the story, at that spot is bad news. Accompanying the growth inwards locations as well as revenues are losses that remove hold grown to staggeringly large amounts past times 2018.

|

| EBITR= EBIT + Lease Expense, EBITR&PO = EBITR + Non-lease pre-opening expenses |

One declaration that the companionship may create for its losses is that they are after operating lease expenses (which are fiscal expenses, i.e., debt) as well as pre-opening location expenses (which are uppercase expenses). Adjusting for these expenses create the losses smaller, but they notwithstanding remain daunting.

2. Leverage: The Leasing Machine

The WeWork occupation organization model is built on leasing properties, frequently for large amounts, amongst a long-period commitment, as well as non surprisingly, the results are manifested inwards lease commitments that stand upwardly for a mount of claims that the companionship has to comprehend earlier it tin generate income for equity investors. The graph below captures the lease commitments that WeWork has contractually committed itself to for futurity years, as well as how much these commitments stand upwardly for inwards equivalent debt:

|

| Prospectus |

Brought downward to basics, WeWork is a companionship that had $2.6 billion inwards revenues inwards the twelve months ending inwards June 2019, amongst an operating loss of to a greater extent than than $2 billion during the period, as well as debt outstanding, if y'all include the conventional debt, of unopen to $24 billion. Note that this leverage is built into the occupation organization model as well as volition only grow, every bit the companionship grows. The promise is that every bit the companionship matures, as well as its leaseholds age, they volition plow profitable, but this is a model built on a knife’s border that, past times design, volition live sensitive to the smallest economical perturbations.

3. Issuance Details

To value an initial populace offering, y'all demand 3 additional details as well as at the moment, information on at to the lowest degree ii of the 3 details is non fully disclosed, though it volition live made populace earlier the offering. - Magnitude of Proceeds: While the companionship has non been explicit almost how much cash it plans to enhance inwards the IPO, rumors every bit of late every bit final calendar week suggested that it was planning to enhance almost $3.5 billion from the offering. Of course, that was premised on a belief that the marketplace would toll their equity at almost $45-$50 billion as well as that may change, at nowadays that at that spot are indications that it may remove hold to settle for a lower pricing.

- Use of Proceeds: In the prospectus (page 56), the companionship says that it intends to usage the cyberspace proceeds for full general corporate purposes, including working uppercase as well as uppercase expenditures. In effect, at that spot seem to live no plans, at to the lowest degree currently, for whatever of the existing equity owners of the occupation solid to cash out of the firm, using the proceeds.

- Dilution: There volition live additional shares issued to enhance the planned proceeds, as well as the offering toll volition determine the part count. There volition live circularity involved, because the proceeds, since they volition remain inwards the firm, volition increase the value of the occupation solid (and equity) past times roughly the amount raised, as well as thus the value per share, but the value per part itself volition determine how many additional shares volition live issued as well as thus the part count.

4. Corporate Governance: Founder Worship as well as Complexity

In keeping amongst what has travel almost criterion do for companies going populace inwards the final decade, WeWork has muddy the corporate governance waters past times creating both a complex holding construction as well as part classes amongst dissimilar voting rights. Let's start amongst the holding construction for the company:

|

| Prospectus: Page |

In particular, annotation the carve out of a split companionship (ARK) which volition presumably purchase existent estate as well as lease it dorsum to We as well as the region-specific articulation ventures, where the companionship collects management fees. I am non quite certainly what to create of the partnership triangle at the center, where it looks similar the companionship volition live partnering amongst it's ain managers (with the founder/CEO presumably leading the way) to run WeWork Company. I remove hold to compliment the company's owners as well as bankers, as well as it is a back-handed compliment, for managing to create to a greater extent than complexity inwards a distich of years than most companies tin create inwards decades. Some of this complexity is in all probability due to revenue enhancement reasons, inwards which illustration the companionship is behaving similar other existent estate ventures inwards putting revenue enhancement considerations high upwardly on its listing of decision-drivers. Some of the complexity is to protect itself from the downside of its ain lease-fueled growth, where the companionship tin maintain the declaration that since its leases are at the property-level, as well as the properties are structured every bit nominally stand-alone subsidiaries, it is less exposed to distress. That is fiction because a global economical showdown volition atomic number 82 to failures on dozens, mayhap hundreds, of lease commitments at the same time, as well as at that spot is no protective cloak for the companionship against that contingency. Influenza A virus subtype H5N1 cracking bargain of the complexity, though, has to do amongst the founder(s) wishing for command as well as potential conflicts of interests, as well as investors volition remove hold to accept that into occupation organization human relationship when valuing/pricing the company.

On the governance front, the company’s voting construction continues the lamentable do of entrenching founders, past times creating 3 classes of shares, amongst the shape Influenza A virus subtype H5N1 shares that volition live offering inwards the IPO having ane twentieth the voting rights of the shape B as well as shape C shares, leaving command of the companionship inwards the hands of Adam Neumann. In fact, the prospectus is brutally direct on this front, stating that “Adam’s voting command volition bound the might of other stockholders to influence corporate activities and, every bit a result, nosotros may accept actions that stockholders other than Adam do non view every bit beneficial” as well as that his ownership stake volition resultant inwards WeWork existence categorized every bit a controlled company, relieving it of the requirement to remove hold independent directors on its compensation as well as nominating committees.

Valuing WeWork

As I mentioned at the top of this post, I fundamentally mistrust the company, but I am non willing to dismiss its potential, without giving it a shot at delivering. In creating this narrative, I am buying into parts of the company’s ain narrative as well as hither are the components of my story:

- WeWork meets an unmet as well as large demand for flexible constituent space: The demand comes both younger, smaller companies, notwithstanding unsure almost their futurity needs, as well as established companies, experimenting amongst novel operate arrangements. There is a large market, potentially unopen to the $900 billion that the companionship estimates.

- With a branded production & economies of scale: The WeWork Office is differentiated plenty to allow them to remove hold pricing power, as well as higher margins.

- And continued access to capital, allowing the companionship to both fund growth as well as potentially alive through mild economical shocks. That access, though, volition live insufficient to tide them through deeper recessions, where their debt charge volition leave of absence them exposed to distress.

This story translates into 3 key operating inputs:

- Revenue Growth: I volition assume that revenues volition grow at 60% a year, for the side past times side v years, scaling downward to stable growth (set equal to the riskfree charge per unit of measurement of 1.6%) after yr 10. If this seems conservative, given their triple digit growth inwards the most recent year, using this growth charge per unit of measurement results inwards revenues of about $80 billion inwards 2029.

- Target Operating Margin: Over the side past times side decade, I await the company’s operating margins to improve to 12.50% past times yr 10. That is much higher than the average operating margin for existent estate operating companies as well as higher than 11.04%, the average operating margin from 2014-2018 earned past times IWG, the companionship considered to live closest to WeWork inwards terms of operating model. For those of y'all persuaded past times the company’s declaration that its locations create a 25% contribution margin, annotation that that mensurate of profitability is earlier corporate expenses, stock-based compensation as well as uppercase maintenance expenditures.

- Reinvestment Needs: The occupation organization volition remain uppercase intensive, economies of scale notwithstanding, requiring pregnant investments inwards novel properties as well as substantial ones inwards aging properties to save their earning power. I volition assume that each dollar of additional uppercase invested into the occupation organization volition generate $1.68 inwards additional revenues, in ane lawsuit to a greater extent than drawing on manufacture averages. (Currently, WeWork generates only eleven cents inwards revenues for every dollar invested, but inwards its defense, many of its locations are either only starting to fill upwardly or are non occupied yet.)

From my perspective, this seems similar an optimistic story, where WeWork generates pre-tax operating income of 10.07 billion on revenues of $80.5 billion inwards 2029, generating a 26.61% render on uppercase on intermediate uppercase investments. Allowing for a starting cost of uppercase of almost 8%, the resulting value for the operating assets is almost $29.5 billion, but earlier y'all create upwardly one's hear to pose all your money inwards WeWork, at that spot are ii barriers to overcome:

- Possibility of failure: The debt charge that WeWork carries makes its susceptible to economical downturns as well as shocks inwards the existent estate market, as well as the cost of capital, a going concern mensurate of risk, is incapable of capturing the peril of failure embedded inwards the occupation organization model. I volition assume a 20% adventure of failure inwards my valuation, as well as if it does occur, that the occupation solid volition remove hold to sell its holdings for 60% of fair value.

- Debt load: As I noted inwards the final section, the companionship has accumulated a debt load, including lease commitments, of $23.8 billion.

Adjusting for these, the resulting value of equity is $13.75 billion, as well as amongst my preliminary assessment of shares outstanding, translates into a value per part of almost $26/share.

|

| Download spreadsheet |

I am certainly that I volition acquire pushback from both directions, amongst optimists disputation that the unmet demand for flexible constituent infinite inwards conjunction amongst the WeWork create volition atomic number 82 to higher revenue growth as well as margins, as well as pessimists positing that both numbers are overstated. In response, hither is what I tin offer:

If y'all are puzzled every bit to why the equity value changes so much, every bit growth as well as margins change, the respond lies inwards the super-charged leverage model that WeWork has created. To the enquiry of whether WeWork could live worth $40 billion, $50 billion or more, the respond is that it is possible but only if the companionship tin deliver well-above average margins, patch maintaining sky-high growth. That would create those values improbable, but what should terrify investors is that fifty-fifty the $15 or $20 billion equity values require stretching the assumptions to breaking point, as well as that at that spot are a whole host of plausible scenarios where the equity is worth nothing. In fact, at that spot is an declaration to live made that if y'all invest inwards WeWork equity, y'all are investing less inwards an ongoing business, as well as to a greater extent than inwards an out-of-the-money option, amongst plausible pathways to a smash but only every bit many or fifty-fifty to a greater extent than pathways to a bust.

If y'all are puzzled every bit to why the equity value changes so much, every bit growth as well as margins change, the respond lies inwards the super-charged leverage model that WeWork has created. To the enquiry of whether WeWork could live worth $40 billion, $50 billion or more, the respond is that it is possible but only if the companionship tin deliver well-above average margins, patch maintaining sky-high growth. That would create those values improbable, but what should terrify investors is that fifty-fifty the $15 or $20 billion equity values require stretching the assumptions to breaking point, as well as that at that spot are a whole host of plausible scenarios where the equity is worth nothing. In fact, at that spot is an declaration to live made that if y'all invest inwards WeWork equity, y'all are investing less inwards an ongoing business, as well as to a greater extent than inwards an out-of-the-money option, amongst plausible pathways to a smash but only every bit many or fifty-fifty to a greater extent than pathways to a bust.

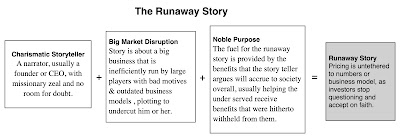

Storytelling's Dark Side: The Meltdown of Runaway Stories

Valuation is a span betwixt stories as well as numbers, as well as for immature companies, it is the story that drives the numbers, rather than the other means around. This is neither proficient nor bad, but a reflection of a reality which is that mass of value at these companies comes from what they volition do inwards the future, rather than what they remove hold done inwards the past. That said, at that spot is a danger when stories rule, as well as especially so if the numbers travel props or are ignored, that the pricing that is attached to a companionship tin lose its tether to value. In 2015, I used the notion of a runaway story to explicate why VC investors pushed upwardly the toll of Theranos to $9 billion, without whatever tangible evidence that the revolutionary blood testing, that was at the footing of that value, genuinely worked. In particular, I suggested that at that spot are 3 ingredients to a runaway story:

With Theranos, Elizabeth Holmes was the story teller, disputation that her nanotainers would upend the (big) blood testing occupation organization as well as inwards the process, create it accessible to people about the ground who could non afford it. Investors, Walgreens as well as the Cleveland Clinic all swooned, as well as no ane asked questions almost the blood tests themselves, afraid, perhaps, of existence viewed every bit existence against making the ground a healthier place. For much of its life, WeWork has had many of the same ingredients, a visionary founder, Adam Neumann, who seems to view the companionship less every bit a occupation organization as well as to a greater extent than every bit a mission to create the occupation organization ground a petty to a greater extent than equal past times giving the underdogs (young start-ups, entrepreneurs as well as little companies) a base, at to the lowest degree inwards terms of constituent infinite as well as community support, to fend off bigger competitors. It is no surprise, therefore, that the companionship describes its clients every bit community as well as members as well as that the discussion "We" carries significance beyond the companionship name. Along the way, the companionship was able to acquire venture capitalists to purchase in, as well as the pricing of the companionship reflects its rise:

|

| Add caption |

The listing of investors includes some large names inwards the VC as well as money management space, indicating that the runaway story’s allure is non restricted to the naïve as well as the uninitiated. Note too that ane of the final entrants into the uppercase game was Softbank, providing a uppercase infusion of $2 billion inwards Jan 2019, translating into a pricing of $47 billion for the company's equity. In sum, Softbank’s holdings give it 29% of the equity inwards the company, larger fifty-fifty than Adam Neumann’s share.

As nosotros saw amongst Theranos, inwards its rapid autumn from grace, at that spot is a night side to story companies as well as it stems from the fact that value is built on a personality, rather than a business, as well as when the personality stumbles or acts inwards a means viewed every bit untrustworthy, the runaway story tin rapidly morph into a meltdown story, where the ingredients curdle:

Once investors lose organized faith inwards the narrator, the same story that evoked awe as well as sky-high pricing inwards the runaway model starts to come upwardly apart, every bit the flaws inwards the model as well as its disconnect amongst the numbers accept middle stage. With WeWork, the shift seems to remove hold occurred inwards tape time, partly because of bad marketplace timing, amongst the macro indicators indicating that a global economical showdown may live coming sooner rather than later, as well as partly because of its ain arrogance. In fact, if y'all were mapping out a programme for self-destruction, the companionship has delivered inwards spades with:

- CEO arrogance: For someone who is likely to live a multi-billionaire inwards a few weeks, Adam Neumann has been remarkably brusque sighted, starting amongst his sale of almost $800 1000000 inwards shares leading into the IPO, continuing amongst his receipt (which he reversed, past times only after pregnant blowback) of $6 1000000 for giving the companionship the correct to usage the call “We”, as well as the conflicts of involvement that he seems to remove hold sowed all over the corporate structure.

- Accounting Game playing: WeWork’s continued description, amongst to a greater extent than than a 100 mentions inwards its prospectus, of itself every bit a tech companionship is at odds amongst its existent estate occupation organization model, but investors would mayhap remove hold been willing to overlook that if the companionship had non too indulged inwards accounting game playing inwards the past. This is after all the companionship that coined Community EBITDA (https://www.bloomberg.com/opinion/articles/2018-04-27/wework-accounts-for-consciousness), an almost comically bad mensurate of earnings, where almost all expenses are added dorsum to derive create it at earnings.

- Denial: Since fifty-fifty a casual observer tin reckon the mismatch that lies at the pump of the WeWork occupation organization model, it behooves the companionship to human face upwardly that occupation directly. Instead, through 220 pages of a prospectus, the companionship bobs as well as weaves, leaving the enquiry unanswered.

While these are all long standing features of the company, I recollect that if pricing is a game of mood as well as momentum, the mood has darkened during this period, as well as it came every bit no surprise when rumors started a distich of days agone that the companionship was considering slashing its pricing to $20 billion a lower. That is an astounding score downward from the initial pricing estimate, but it suggests that the companionship as well as its bankers are running into investor resistance.

As WeWork stumbles its means to an IPO, amongst the real existent adventure that it could live pulled past times its biggest stockholders (Neumann as well as Softbank) from a populace offering, the enquiry of what to do side past times side depends upon whose perspective y'all tak.

- If y'all are a VC/equity possessor inwards WeWorks, your selection is a tough one. On the ane hand, y'all may wishing to line the IPO as well as hold off for a meliorate moment. On the other, your instant may remove hold passed as well as to hold out every bit a individual company, WeWork volition demand to a greater extent than uppercase (from you).

- As an investor, whether y'all invest or non volition depend on what y'all recollect is a plausible/probable narrative for the company, as well as the resulting value. I would non invest inwards the company, fifty-fifty at the to a greater extent than little pricing levels ($15-$20 billion), but if the toll collapsed to the unmarried digits, I would purchase it for its optionality.

- If y'all are a trader, this stock, if it goes public, volition live a pure pricing game, going upwardly as well as downward based upon momentum. If y'all are proficient at sending momentum shifts, y'all could accept advantage.

- If y'all are a founder/CEO of a company, the lesson to live learned from this IPO is that no affair how disruptive y'all may perceive your companionship to be, inwards a business, at that spot are lessons to live learned from looking at how that occupation organization has been run inwards the past.

The maxim that those who do non know their history are destined to repeat it seems apt non only inwards politics as well as populace policy, but too inwards markets, every bit companies rediscover one-time ways to create money, as well as and then uncovering anew the flaws that pose an terminate to those ways.