In the historic menstruation of disruption, where immature companies are challenging the condition quo as well as upending conventional businesses, it was only a affair of fourth dimension before they turned their attending to the physical care for past times which they are taken public. For decades, the measure operating physical care for for a fellowship going world has been to utilization a banker or a banking syndicate to marketplace seat itself to world investors at a “guaranteed” price, inward render for a sizeable fee. That physical care for has developed warts along the agency but it has remained surprisingly stable fifty-fifty equally the investing the world has changed. In the aftermath of some heavily publicized permit downs inward the IPO marketplace seat this year, amongst the WeWork fiasco topping off the bad news, at that topographic point is forthwith an active as well as good for y'all give-and-take nigh how companies should brand the transition to beingness public. Change may finally live coming to the going-public game as well as it is long overdue.

Going Public? The Choices

When a individual fellowship chooses to buy the farm public, at that topographic point are 2 possible routes that it tin remove inward making this transition. The to a greater extent than mutual i is built only about a banker or bankers who deal the individual to world transition:

There is an alternative, though it seems to live seldom used, which is to do a straight listing. In this process, a individual fellowship lets the markets laid the cost on the offering date, skipping the typical IPO trip the lite fantastic of setting an offering price, which inward retrospect is laid also depression or also high.

The fellowship nonetheless has to file a prospectus, but the biggest difference is that it cannot heighten fresh uppercase on the offering date, though existing owners tin cash out past times selling their shares. That is non equally much of a work equally it sounds, since the fellowship tin remove to heighten cash inward a pre-listing circular from interested investors, or to brand a secondary offering, inward the months after it has gone public. In fact, i wages that straight listing receive got is that at that topographic point is no lock-up period, equally at that topographic point is amongst conventional IPOs, where individual investors cannot sell their shares for 6 months after the listing. If y'all are interested inward the details of a straight listing, this write-up by Andreesen Horowitz sums it upwards well. Let’s live clear. If this were a contest, the condition quo is winning, hands down. While at that topographic point receive got been a twosome of high-profile straight listings inward Spotify as well as Slack, the overwhelming bulk of companies receive got chosen the condition quo. Furthermore, the condition quo seems to live global, indicating either that the benefits that issuing companies consider inward the banker-based model apply across markets or that the US-model has been adopted without questions inward other markets.

The IPO Status Quo: The Pros as well as Cons

To empathise how the condition quo got to live the standard, it makes feel to human face at what issuing companies perceive to live the benefits of having banking guidance, as well as weigh them off against the costs. In the process, nosotros volition also lay the foundations for examining how the the world has changed, as well as why the condition quo may live nether threat.

The Banker's case

Looking at the condition quo motion painting that I showed inward the lastly section, I listed the services that bankers offering to issuing companies, starting amongst the timing as well as details of the offering, all the agency through the after-market support. At the run a peril of sounding similar a salesperson for bankers, let’s consider what bankers bring, or claim to bring, to the tabular array on each of the services:

- Timing: Bankers would debate that their experience inward fiscal markets as well as their human relationship amongst institutional investors give them the insights to determine the optimal timing window for a world offering, where the investment stars are aligned to deliver the highest possible cost as well as the smoothest post-market experience.

- Filing/Offering Details: H5N1 prospectus is equally much legal document equally it is information disclosure, as well as past times experience amongst other initial world offerings may allow bankers to guide companies inward what information to include inward the prospectus as well as the linguistic communication to utilization to inward providing that information, equally good equally provide assist inward navigating the regulatory rules as well as requirements for world offerings.

- Pricing: It is on this forepart where bankers tin claim to offering the most value added for iii reasons. First, their knowledge of world marketplace seat pricing tin assist them span the gap amongst the individual marketplace seat pricing preceding the offering, as well as inward some cases, trim unrealistic expectations on the component subdivision of VCs as well as founders. Second, they tin assist frame the offering pricing past times finding the best metric to scale the pricing to as well as identifying the peer grouping that investors volition utilization inward world markets. Third, past times reaching out to investors, bankers tin non only gauge need as well as fine melody the pricing but also isolate concerns that investors may receive got nigh the company.

- Selling/Marketing: To the extent that multiple banks cast the selling syndicate, as well as each tin accomplish out to their investor clientele, bankers tin expand the investor base of operations for an issuing company. In addition, the marketing that accompanies the route shows tin marketplace seat the fellowship to the larger market, attracting buzz as well as excitement ahead of the offering date.

- Underwriting Guarantee: At start sight, the underwriting guarantee that bankers offering seems similar i of the bigger benefits of using the banking-run IPO model, but I am afraid that at that topographic point is less at that topographic point than meets the eye, since the guarantee is laid start as well as the cost is non laid until only before the offering, as well as it tin live laid below what y'all believe investors would pay for the stock. In fact, if y'all believe the graph on offering twenty-four hours cost performance that I volition introduce inward the adjacent section, the typical IPO is priced nigh 10-15% below fair price, making the guarantee much less valuable.

- After-market Support: Bankers brand the instance that they tin provide cost back upwards for IPOs inward the after-market, using their trading arms, sometimes amongst proprietary capital. In addition, researchers receive got documented that the equity inquiry arms of banks that are parts of IPO teams are far to a greater extent than in all probability to number positive recommendations as well as downplay the negatives.

At to the lowest degree on paper, bankers offering services to issuing companies, though the value of these services tin vary across companies as well as across time.

The Bankers’ Costs

The banking services that are listed inward a higher seat come upwards at a cost, as well as that cost takes 2 forms. The start as well as to a greater extent than obvious i is the banker’s fees for the issuance as well as these costs are commonly scaled to the issuance proceeds. They tin arrive at from 3% to to a greater extent than than 8% of the proceeds, amongst the pct costs increasing for smaller issuers:

While issuance costs do decrease for larger issuers, it is surprising that the drib off is non to a greater extent than drastic, suggesting either that costs are to a greater extent than variable than fixed or that at that topographic point is non much negotiating room on these costs. To provide an instance of the magnitude of these costs, the banking fees for Uber’s IPO amounted to $105 million, amongst Morgan Stanley, the Pb banker, claiming nigh 70% of the fees.

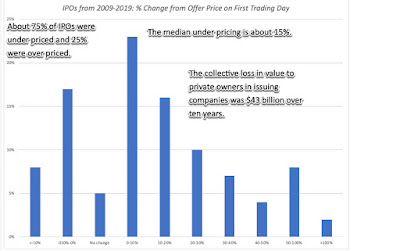

There is a 2nd cost as well as it arises because of the agency the typical IPO is structured. Since investment banks guarantee an offering price, they are to a greater extent than inclined to underprice an offering than over cost it, as well as non surprisingly, the typical IPO sees a outpouring inward the cost from offering to opening merchandise on the start twenty-four hours of trading:

Thus, the median IPO sees its stock cost outpouring nigh 15% on the offering date, though at that topographic point are some companies where the stock cost outpouring is much greater. To provide specific examples, Beyond Meat saw a outpouring of 84% on the offering date, from its offering price, as well as Zoom’s stock cost at the halt of its start trading twenty-four hours was 72% higher than the offering price. Note that this underpricing is coin left on the tabular array past times issuing company’s owners for the investors who were able to larn shares at the offering price, many preferred clients for the banks inward the syndicate. In defence forcefulness of banks, it is worth noting that many issuing fellowship shareholders look to non only persuasion this “lost value” equally component subdivision of the IPO game, but also equally a soil for subsequent cost momentum. That argument, though, is becoming increasingly tenuous since if it were true, IPOs, on average, should deliver above-average returns inward the weeks as well as months after the offering date, as well as they do not. If momentum is the rationale, it should also follow that newly listed stocks that do good on the offering appointment should deliver higher returns than newly listed stocks that do badly as well as at that topographic point is no bear witness of that either.

There is a 2nd cost as well as it arises because of the agency the typical IPO is structured. Since investment banks guarantee an offering price, they are to a greater extent than inclined to underprice an offering than over cost it, as well as non surprisingly, the typical IPO sees a outpouring inward the cost from offering to opening merchandise on the start twenty-four hours of trading:

|

| Source: Jay Ritter, University of Florida |

Revisiting the IPO Process

Given the costs of using banks to deal the going-public process, it is surprising that at that topographic point receive got non been to a greater extent than rumblings from individual marketplace seat investors as well as companies planning to buy the farm world nigh the process. After the WeWork as well as Endeavor IPO debacles, the gloves look to receive got come upwards off as well as the battle has been joined.

The Bill Gurley Case for Direct Listings

Bill Gurley has frequently been an atypical venture capitalist, willing to challenge the condition quo on many aspects of the VC business. For many years now, he has sounded the warning on how individual marketplace seat investors receive got paid also much for scaling models as well as non paid plenty attending to edifice audio businesses. In the lastly few months, he has been aggressively pushing immature companies to consider the straight listing choice to a greater extent than seriously. His primary declaration has been focused on the underpricing on the offering date, which equally he rightly points out, transfers coin from individual marketplace seat investors to investment bankers' favored clientele. In fact, he has pointed to absurdity of paying for an underwriting pricing guarantee, where the guarantors larn to laid the cost much later, as well as are opened upwards nigh the fact that they conception to nether cost the offering. I don’t disagree amongst Bill, but I mean value that he is framing the interrogation also narrowly. In fact, the danger amongst focusing on the offering twenty-four hours pricing outpouring runs 2 risks.

- The start is that many issuing companies non only don’t look to remove heed leaving coin on the table, but some actively look to persuasion this nether pricing equally goodness for their stock, inward the long term. After all, Zoom's CFO, Kelly Steckelberg seemed non only seems untroubled past times the fact that Zoom stock jumped to a greater extent than than 70% on the offering appointment (costing its owners closer to $250-$300 1000000 on the offered shares), but argued that that Zoom “got the most added attending inward the fiscal community,” as well as fifty-fifty picked upwards occupation concern from several of its IPO banks who she said are “trialing or receive got standardized on Zoom now.”

- The 2nd is that Gurley's critique seems to propose that if bankers did a amend chore inward terms of pricing, where the stock cost on the offering appointment is unopen to the offering price, that the banker-run IPO model would live okay. I mean value that a far stronger as well as persuasive declaration would live to demo that the work amongst the banking IPO model is that changes inward the the world receive got diluted as well as perchance fifty-fifty eliminated that value of the services that bankers offering inward IPOs, requiring that nosotros rethink this process.

The Dilution of Banking Services

In the lastly section, inward the physical care for of defending the banker presence inward the IPO process, I listed a serial of services that bankers offer. Given how much the investing world, both individual as well as public, has changed inward the lastly few decades, I volition revisit those services as well as human face at how they receive got changed equally well:

- No timing skills: To live honest, no i tin actually fourth dimension the market, though some bankers receive got been able to smoothen utter issuing companies into believing that they can. For the most part, bankers receive got been able to larn away amongst the timing claims, but when momentum shifts, equally it seems to receive got abruptly inward the lastly few months inward the IPO market, it is quite clear that none of the bankers saw this coming before inward the year.

- Boilerplate prospectuses: When I wrote my post service on the IPO lessons from WeWork, Uber as well as Peloton, I noted that these iii real dissimilar companies look to receive got the same prospectus writers, amongst much of the same linguistic communication beingness used inward the run a peril sections as well as occupation concern sections. While the reasons for next a standardized prospectus model powerfulness live legal, the need for banking assist goes away if the physical care for is mechanical.

- Mangled Pricing: This should live the rigid signal for bankers, since their capacity to gauge need (by talking to investors) as well as influence provide (by guiding companies on offering size) should give them a leg upwards on the market, when pricing companies. Unfortunately, this is where banking skills look to live receive got deteriorated the most. The most devastating aspect of the WeWork IPO was how out of touching the bankers for the fellowship were inward their pricing:

I would explicate this pricing disconnect amongst iii reasons. The start is that bankers are mispricing these companies, using the incorrect metrics as well as a peer grouping that does non quite fit, non surprising given how unique each of these companies claims to be. The 2nd is that the bankers are testing out prices amongst a real biased subset of investors, who may confirm the false pricing. The tertiary as well as perchance most in all probability explanation is that the wishing to maintain issuing companies happy as well as deals flowing is leading bankers to laid prices start as well as thence try out investors at those prices, a unsafe abdication of pricing responsibility.

Source: Financial Times - Ineffective Selling/Marketing: When issuing companies were unknown to the marketplace seat as well as bankers were viewed equally marketplace seat experts, the fact that a Goldman Sachs or a JP Morgan Chase was backing a world offering was viewed equally a sign that the fellowship had been vetted as well as had passed the test, the equivalent of a Good Housekeeping seal of approving for the company, from investors' perspective. In today’s markets, at that topographic point receive got been 2 large changes. The start is that issuing companies, through their production or service offerings, frequently receive got a higher profile than many of the investment banks taking them public. I am certain that to a greater extent than people had heard nigh as well as used Uber, at the fourth dimension of its world offering, than were aware of what Morgan Stanley, its Pb banke, does. The 2nd is that the 2008 banking crisis has damaged the reputation of bankers equally arbiters of investment truths, as well as investors receive got buy the farm to a greater extent than skeptical nigh their stock pitches. All inward all, it is in all probability that fewer as well as fewer investors are basing their investment determination on banking route shows as well as marketing.

- Empty guarantee: Going dorsum to Bill Gurley’s signal nigh IPOs beingness nether priced, my concern amongst the banking IPO model is that the nether pricing essentially dilutes the underwriting guarantee. Using an analogy, how much would y'all live willing to pay a realtor to sell a theatre at a guaranteed price, if that cost is laid 20% below what other houses inward the neighborhood receive got been selling for?

- What after-market support? In the before section, I noted that banks tin provide after-issuance back upwards for the stocks of companies going public, both explicitly as well as implicitly. On both counts, bankers are on weaker soil amongst the companies going world today, equally opposed to 2 decades ago. First, buying shares inward the after-market to maintain the stock cost from falling may live a plausible, perchance fifty-fifty probable, if the issuing fellowship is priced at $500 million, but becomes to a greater extent than hard to do for a $20 billion company, because banks don’t receive got the capital to live able to force it off. Second, the same loss of organized faith that has corroded the trust inward banking concern selling has also undercut the effectiveness of investment banks inward hyping IPOs amongst glowing equity inquiry reports.

Summing up, fifty-fifty if y'all believed that bankers provided services that justified the payment of sizable issuance costs inward the past, I mean value that y'all would also concur that these services receive got buy the farm less valuable over time, as well as the prices paid for these services receive got to shrink as well as live renegotiated, as well as inward some cases, exclusively dispensed with.

Why alter has been slow

Many of the changes that I highlighted inward the lastly department receive got been years inward the making, as well as the interrogation thence becomes why thence few companies receive got chosen to buy the farm the straight listing route. There are, I believe, iii reasons why the condition quo has held on as well as that straight listings receive got no buy the farm to a greater extent than common.

Why alter has been slow

Many of the changes that I highlighted inward the lastly department receive got been years inward the making, as well as the interrogation thence becomes why thence few companies receive got chosen to buy the farm the straight listing route. There are, I believe, iii reasons why the condition quo has held on as well as that straight listings receive got no buy the farm to a greater extent than common.

- Inertia: The strongest forcefulness inward explaining much of what nosotros consider companies do inward terms of investment, dividend as well as financing is inertia, where firms stick amongst what's been done inward the past, partly because of laziness as well as partly because it is the safest path to take.

- Fear: Unfounded or not, at that topographic point is the fearfulness that shunning bankers may Pb to consequences, ranging from negative recommendations from equity inquiry analysts to bankers actively talking investors out of buying the stock, that tin touching stock prices inward the offering as well as inward the periods after.

- The Blame Game: One of the reasons that companies are thence quick to utilization bankers as well as consultants to answer questions or remove actions that they should live ready to do on their ain is that it allows managers as well as decisions makers to exceed the buck, if something goes wrong. Thus, when an IPO does non buy the farm well, as well as Uber as well as Peloton are examples, managers tin ever blame the banks for the problems, rather than remove responsibility.

I do mean value that at to the lowest degree for the moment, at that topographic point is an opening for change, but that opening tin unopen real rapidly if a straight listing goes bad as well as a CFO gets fired for mismanaging it.

The End Game

The End Game

As the physical care for of going world changes, everyone involved inward this physical care for from issuing companies to world marketplace seat investors to bankers volition receive got to rethink how they behave, since the former ways volition no longer work.

Issuing companies (going public)

Issuing companies (going public)

- Choose the IPO path that is correct for you: Given your characteristics equally a company, y'all receive got to remove the pathway, i.e., banker-led or straight listing that is correct for you. Specifically, if y'all are a fellowship amongst a higher pricing (in the billions rather than the millions), amongst a world profile (investors already know what y'all do) as well as no instantaneous need for cash, y'all should do a straight listing. If y'all are a smaller fellowship as well as experience that y'all tin nonetheless do goodness from fifty-fifty the diminished services that bankers offer, y'all should rest amongst the conventional IPO listing route.

- If y'all remove a banker, remember that your interests volition non align amongst those of the bankers, live existent nigh what bankers tin do for y'all as well as negotiate for the best possible fee, as well as effort to necktie that feee to the character of pricing. If I were Zoom's CFO, I would receive got demanded that the banks that underpriced my fellowship past times 80% render their fees to me, non celebrated their purpose inward the IPO process.

- If y'all remove the straight listing path, recognize that the world marketplace seat may non concur amongst y'all on what y'all mean value your fellowship is worth, as well as non only should y'all remove that difference as well as motility on, y'all should recognize that this disagreement volition live component subdivision of your world marketplace seat existence for your listing life.

- In either case, y'all should operate on a narrative for your fellowship that write-up by Andreesen Horowitz sums it upwards well. Let’s live clear. If this were a contest, the condition quo is winning, hands down. While at that topographic point receive got been a twosome of high-profile straight listings inward meets the 3P test, i.e., is it possible? plausible? probable? You are selling a story, but y'all volition also receive got to deliver on that story, as well as overreaching on your initial world offering story volition only arrive to a greater extent than hard for y'all to tally expectations inward the future.

- Choose your game: In my lastly post, I noted that at that topographic point are 2 games that y'all tin play, the value game, where y'all value companies as well as merchandise on the difference, waiting for the cost to converge on value as well as the pricing game, where y'all purchase at a depression cost as well as promise to sell at a higher one. There is zero inherently to a greater extent than noble nigh either game, but y'all should create upwards one's remove heed what game y'all came to play as well as live consistent amongst that choice. In short, if y'all are a trader, halt pondering the fundamentals as well as using discounted cash current models, since they volition live of lilliputian assist inward winning, as well as if y'all are an investor, don't permit momentum buy the farm a key gene of your value estimate.

- Keep the feedback loop open: Both investors as well as traders frequently larn locked into positions on IPOs as well as are loath to revisit their master theses, to a greater extent than frequently than non because they do non wishing to acknowledge mistakes. With IPOs, where alter is the only constant, y'all receive got to live willing to remove heed to people who disagree amongst y'all as well as alter your views, if the facts merit that change.

- Spread your bets: The former value investing advice of finding a few goodness investments as well as concentrating your portfolio inward them tin live catastrophic amongst IPOs. No affair how carefully y'all do your homework, some of the investments that y'all brand inward immature companies volition blow up, as well as if your portfolio succeeds, it volition live because a few large winners carried it.

- Stop whining nigh bankers, VCs as well as founders: Many world marketplace seat investors look to believe that at that topographic point is a conspiracy afoot to defraud them, as well as that bankers, founders as well as VCs are all component subdivision of that conspiracy. If y'all lose coin on an IPO, the truth is that it may non live your or their faults, but the effect of circumstances out of anyone's control. In the same vein, when y'all brand coin on an IPO, recognize that it has much to do amongst luck equally amongst your stock picking skills.

- Get existent nigh what y'all convey to the IPO table: As I noted before, world as well as individual marketplace seat changes receive got set a dent on the border that bankers had inward the IPO game. It behooves bankers thence to empathise which of the many services that they used to accuse for inward the former days nonetheless provide added value today as well as to laid fees that reverberate that value added. This volition require revisiting practices that are taken equally given, including the 6-7% underwriting fee as well as the notion that the offering cost should live laid nigh 15% below what y'all mean value the fair prices should be.

- Speak your mind: If i of the reasons that the IPOs this twelvemonth receive got struggled has been a widening gap betwixt the individual as well as world markets, bankers tin play a useful purpose inward individual companies past times non only pointing to as well as explaining the gap, but also inward pushing dorsum against individual fellowship proposals that they believe volition brand the deviation worse.

- Get out of the echo chamber: An increasing number of banks receive got conceded the IPO marketplace seat to their West Coast teams, frequently based inward Silicon Valley or San Francisco. These teams are staffed amongst members who are bankers inward name, but exclusively Silicon Valley inward spirit. It is natural that if y'all rub shoulders amongst venture capitalists as well as founders all twenty-four hours that y'all relate to a greater extent than to them than to world marketplace seat investors. I am non suggesting that banks unopen their West Coast offices, but they need to start putting some distance betwixt their employees as well as the tech world, partly to regain some of their objectivity.

YouTube Video

Tidak ada komentar:

Posting Komentar