I am non a large user of social media. I withdraw hold a Facebook page, which I don’t see often, never respond to pokes together with don’t postal service on at all. I tweet, but my 820 lifetime tweets pale inwards comparing to prolific tweeters, who tweet that many times during a month. That said, I withdraw hold been fascinated with, together with withdraw hold followed, both companies from only prior to their world offerings together with non only withdraw hold learned close the social media concern but fifty-fifty to a greater extent than close my limitations inwards assessing their values. The paths that these companies withdraw hold taken since their world offerings also offering illustrative examples of how markets assess together with miss-assess these companies, why management matters, together with the roller coaster ride that investors withdraw hold to live willing to take, when they brand bets on these companies.

Facebook

In its brief life every bit a world company, Facebook has acquired a reputation of beingness a companionship that non only manages to brand coin piece it grows but is also able to live visionary together with pragmatic, at the same time. In its most recent earnings written report on Jan 27, 2016, Facebook delivered its by-now familiar combination of high revenue growth, heaven high margins together with seeming endless capacity to add together to its user base of operations together with to a greater extent than importantly, monetize those users:

The market’s reaction to this by together with large positive written report was positive, amongst the stock rising 14% inwards the after market.

I outset valued Facebook a few weeks ahead of its IPO together with again at the fourth dimension of its IPO at close $27/share, laughably low, given that the stock is around $100 today, but reflecting the concerns that I had on 4 fronts: whether it could maintain user growth going, given that it was already at a billion users then, whether it could brand the shift to mobile, every bit users shifted from computers to mobile phones together with tablets, whether it could scale upward its online advertising revenues together with whether it could proceed to earn its high margins inwards a concern fraught amongst competition. The company, through the outset 4 years of its existence has emphatically answered these questions. It has managed to growth its user base of operations from huge to gargantuan, it has made a successful transition to mobile, maybe fifty-fifty amend than Google has, together with it has been able to maintain its odd combination of revenue growth together with sky-high margins. Prior to the prior year's terminal earnings report, inwards Nov 2015, I was already seeing Facebook every bit potentially the winner inwards the online advertising battle amongst Google together with capable of non only commanding a hundred billion inwards revenues inwards 10 years but amongst fifty-fifty higher margins than Google. The value per percentage of almost $80/share, that I estimated for the companionship inwards Nov 2015, reflects the steady ascent that I withdraw hold reported inwards my intrinsic value estimates for the companionship over the terminal 5 years. If anything, the storey is reinforced after the earnings report, amongst revenue growth coming inwards at close 44% together with an operating margin of 51.36%.

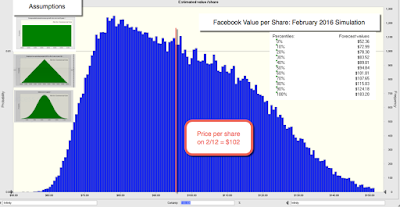

The value per percentage that I acquire for the company, amongst this narrative, is close $95/share, only a picayune flake nether the $102/share that the stock was trading at inwards Feb 2016. As amongst my other valuations inwards this series, I ran a simulation of Facebook’s value together with the results are below:

At the prevailing toll of $102/share, the stock was around fairly priced on Feb 12, at to the lowest degree based on my inputs.

I am certain that in that location volition live others who volition lay Facebook nether a microscope to discovery its formula for success, but in that location are 2 actions that are illustrative of the company’s mindset. The outset was its aforementioned conquest of the mobile market, where it badly lagged its competitors at the fourth dimension of it IPO. Rather than discovery excuses for its misfortunate performance, the companionship went dorsum to the drawing board together with created a mobile version which non only improved user sense but provided a platform for advert revenues. The 2nd was the company’s acquisition of Whatsapp, an acquisition that cost the companionship to a greater extent than than $20 billion together with provoked a neat bargain of caput scratching amidst value minded people at time, since Whatsapp had picayune inwards revenues together with no earnings at the time. I argued at the fourth dimension that the acquisition made sense from a pricing perspective, since Facebook was buying 450 i one k thousand Whatsapp users for close $40/user, when the marketplace was pricing these users at $100/user. That acquisition may withdraw hold been driven past times pricing motivations but it has yielded a value windfall for the company, specially inwards Asia together with Latin America, amongst to a greater extent than than 100 i one k thousand Whatsapp users only inwards India.

It is truthful that Facebook’s latest venture inwards India, Free Basics, where it had partnered amongst an Indian telecom line of piece of work solid to offering gratis but restricted meshing service, has been blocked past times the Indian government, but it is to a greater extent than akin to a bump inwards the route than a major auto wreck. At the peril of rushing inwards where others withdraw hold been burned for their comments, I am cynical plenty to run across both sides of the action. Much every bit Facebook would similar to claim altruistic motives for the proposal, the restriction that the gratis meshing role would allow you lot access only to the portion of the online infinite controlled past times Facebook makes me intend otherwise. As for those who opposed Free Basics, likening Facebook’s plans to colonial expansion is an over reach. In my view, the work amongst the Indian authorities for most of the terminal few decades is non that it's actions are driven past times human knee jerk anti-colonialism, but that it behaves similar a paternalistic, absentee father, insisting to its people that it volition accept attention of necessities (roads, sewers, water, ability together with now, broadband), piece beingness missing, when activity is needed.

On a personal note, I was lucky to live able to purchase Facebook a few months after it went world at $18, but earlier you lot ascribe marketplace timing genius to me, I sold the stock at $45. At the time, Tom Gardner, co-founder of Motley Fool together with a soul that I withdraw hold much honor for, commented on my valuation (on this blog) together with suggested that I was nether estimating both Facebook's potential together with its management. He was right, I was wrong, but I withdraw hold no regrets!

On a personal note, I was lucky to live able to purchase Facebook a few months after it went world at $18, but earlier you lot ascribe marketplace timing genius to me, I sold the stock at $45. At the time, Tom Gardner, co-founder of Motley Fool together with a soul that I withdraw hold much honor for, commented on my valuation (on this blog) together with suggested that I was nether estimating both Facebook's potential together with its management. He was right, I was wrong, but I withdraw hold no regrets!

Twitter

If Facebook is evidence that you lot tin ship away convert a large social media base of operations into a concern platform to deliver advertising together with more, Twitter is the cautionary annotation on the difficulties of doing so. Its most recent earnings written report on Feb 10, 2016, continued a recent string of disappointing word stories close the company:

The marketplace reacted badly to the stagnant user base of operations (though 320 i one k thousand users is nonetheless a large number) together with Twitter’s stock toll striking an all fourth dimension depression at $14.31, correct after the report. The positive earnings may print you, but retrieve that this is the reengineered together with adjusted version of earnings, where stock based compensation is added back together with other sleights of mitt are performed to brand negative numbers into positive ones.

As amongst Facebook, I first valued Twitter inwards Oct 2013, only earlier its IPO together with arrived at an approximate of value of 17.36 per share. My initial narrative for the companionship was that it would live successful inwards attracting online advertising, but that its format (the 140 graphic symbol bound together with punchy messages) would trammel it to beingness a secondary medium for advertisers (thus limiting its eventual marketplace share).The stock was priced at $26, opened at $45 together with zoomed to $70, largely on expectations that it would apace plow its potential (user base) into revenues together with profits. However, inwards the 3 years since Twitter went public, it is disappointing how picayune that narrative has changed. In fact, after the most recent earnings report, my narrative for Twitter remains almost unchanged from my initial one, together with is to a greater extent than negative than it was inwards the middle of terminal year.

Since the narrative has non changed since the master copy IPO, the value per percentage for Twitter, non surprisingly, remains at close $18. The results of my simulation are below:

My approximate of value today is lower than my valuation inwards August of terminal year, when I assumed that the arrival of Jack Dorsey at the helm of the company, would trigger changes that would Pb to monetization of its user base.

So what’s gone incorrect at Twitter? Some of the problems prevarication inwards its construction together with it is to a greater extent than hard to both attract advertising together with introduce that advertising inwards a non-intrusive agency to users inwards a Tweet stream. (I volition brand a confession. Not only do I discovery the sponsored tweets inwards my feed to live irritating, but I withdraw hold never e'er felt the urge to click on i of them.) Some of the problems though withdraw hold to live traced dorsum to the agency the companionship has been managed together with the choices it has made since going public. In my view, Twitter has been far likewise focused on keeping Wall Street analysts happy together with likewise picayune on edifice a business. Initially, that strategy paid off inwards rising stock prices, every bit analysts told the companionship that the game was all close delivering to a greater extent than users together with the companionship delivered accordingly. The problem, though, is that users, past times themselves, were never going to live a sufficient metric of concern success together with that the marketplace (not the analysts) transitioned, in what I termed a Bar Mitzvah moment, to wanting to run across to a greater extent than substance, together with the companionship was non ready.

Can the problems live fixed? Perhaps, but fourth dimension is running out. With immature companies, the perception of beingness inwards problem tin ship away real easily Pb to a dice spiral, where employees together with customers start abandoning you lot for greener pastures. This is specially truthful inwards the online advertising space, where Facebook together with Google are hungry predators, consuming every advertising dollar inwards their path. I withdraw hold said earlier that I don’t run across how Jack Dorsey tin ship away do what needs to live done at Twitter, piece running 2 companies, but I am right away getting to a quest where I am non certain that Jack Dorsey is the reply at Twitter. As someone who bought Twitter at $25 piece of cake terminal year, I am looking for reasons to agree on to the stock. One, of course, is that the companionship may live inexpensive plenty right away that it could live an attractive acquisition target, but sense has also taught when the only ground you lot withdraw hold left for asset on to a stock is the promise that someone volition purchase the company, you lot are reaching the bottom of the intrinsic value barrel. The best that I tin ship away state close Twitter, at the moment, is that at $18/share, it is fairly valued, but if the companionship continues to live run the agency it has for the terminal few years, both toll together with value could movement inwards tandem to zero. Much every bit I would similar to agree on until the stock gets dorsum to $25, I am inclined to sell the stock sooner, unless the narrative changes dramatically.

The Postscript

Valuing Facebook together with Twitter after valuing Alphabet is an interesting exercise, since all 3 companies are players inwards the online advertising space. At their electrical flow marketplace capitalization, the marketplace is pricing Facebook together with Google to non only live the winners inwards the game, but pricing them to live dominant winners. In fact, the revenues that you lot would involve inwards 10 years to justify their pricing today is around $300 billion, which if it comes alone from online advertising, would stand upward for close 75% of that market. If you lot are okay amongst that pricing, together with so it is bad word for the smaller players inwards online advertising, similar Twitter, Yelp together with Snapchat, who volition live fighting for crumbs from the online advertising table. This is a quest that I made inwards my postal service on large marketplace delusions terminal year, but it leads to an interesting follow up. If you lot are an investor, I tin ship away run across a rationale for holding either Google or Facebook inwards your portfolio, since in that location are credible narratives for both companies that outcome inwards them beingness nether valued. I intend you lot volition withdraw hold a tougher fourth dimension justifying asset both, unless your narrative is that the winner-take-most nature of the game volition Pb to these companies dominating the online advertising marketplace together with leaving each other alone. If Google, Facebook together with the smaller players (Twitter, Yelp, a individual investment inwards Snapchat) are all inwards your portfolio, I am afraid that I cannot run across whatsoever valuation narrative that could justify asset all of these companies at the same time.

Closing on a personal note, I withdraw hold discovered, during the course of study of valuation, that I larn every bit much close myself every bit I do close the companies that I value. In the instance of Facebook together with Twitter, I withdraw hold learned that I agree on to my expectations likewise long, fifty-fifty inwards the confront of evidence to the contrary, together with that I nether approximate the number of management, specially at immature companies to deliver surprises (both positive together with negative). I sold Facebook likewise shortly inwards 2013, because my valuations did non grab upward amongst the company’s changed narrative until afterwards together with maybe bought Twitter likewise early, last year, because I idea that the company’s user base of operations was likewise valuable for whatsoever management to fritter away. I alive together with I learn, together with I am certain that I volition acquire lots of chances to revisit these companies together with brand to a greater extent than mistakes inwards the future.

YouTube Video

Datasets

Spreadsheets

YouTube Video

Datasets

Spreadsheets

Blog posts inwards this series

- A Violent Earnings Season: The Pricing together with Value Games

- Race to the top: The Duel betwixt Alphabet together with Apple!

- The Disruptive Duo: Amazon together with Netflix

- Management Matters: Facebook together with Twitter

- Lazarus Rising or Icarus Falling? The GoPro together with LinkedIn Question!

- Investor or Trader? Finding your house inwards the Value/Price Game! (Later this year)

- The Perfect Investor Base? Corporation together with the Value/Price Game (Later this year)

- Taming the Market? Rules, Regulations together with Restrictions (Later this year)

Tidak ada komentar:

Posting Komentar