As I spotter GoPro as well as LinkedIn, 2 high flight stocks of non that long ago, come upward dorsum to world my hear is drawn to 2 much told stories. The kickoff is the Greek myth virtually Icarus, a homo who had wings of feathers as well as wax, but as well as then soared so high that the Sun melted his wings as well as he brutal to earth. The other is that of Lazarus, who inwards the biblical story, is raised from the dead, 4 days afterward his burial. As investors, the determination that nosotros human face upward alongside GoPro as well as LinkedIn is whether similar Icarus, they soared besides high as well as bring been scorched (perhaps permanently) or similar Lazarus, they volition come upward dorsum to life.

GoPro: Camera, Smart Phone Accessory or Social Media Company?

GoPro went populace inwards June 2014 at $24/share as well as apace climbed inwards the months next to striking $93.85 inwards Oct of that year. When I kickoff valued the society inwards this post, the stock was all the same trading at to a greater extent than than $70/share. Led past times Nick Woodman, a CEO who had a knack for keeping himself inwards the populace optic (not necessarily a bad matter for publicity seeking start up), as well as selling an activity camera that was taking the world past times storm, the company’s spanning of the camera, smartphone accessory as well as social media businesses seemed to seat it to conquer the world. Even at its peak, though, it was clear the competitive tempest clouds were gathering every bit other players inwards the market, noting GoPro’s success, readied their ain products.

In the terminal year, GoPro lost much of its luster every bit its production offerings bring aged as well as sales growth has lagged expectations. It is a testimonial to these lowered expectations that investors were expecting revenues to drop, relative to the same quarter inwards the prior year, inwards the most recent quarterly earnings written report from the company.

The society reported that it non exclusively grew slower as well as shipped fewer units than expected inwards the most recent quarter, but also suggested that futurity revenues would endure lower than expected. While the company’s defence was that consumers were waiting for the novel GoPro 5, expected inwards 2016, investors were non assuaged. The stock dropped almost 20% on the news, hitting an all-time depression of $9.78, correct afterward the announcement.

The society reported that it non exclusively grew slower as well as shipped fewer units than expected inwards the most recent quarter, but also suggested that futurity revenues would endure lower than expected. While the company’s defence was that consumers were waiting for the novel GoPro 5, expected inwards 2016, investors were non assuaged. The stock dropped almost 20% on the news, hitting an all-time depression of $9.78, correct afterward the announcement.

To evaluate how the disappointments of the terminal yr bring impacted value, I went dorsum to Oct 2014, when I valued the stock at $30.57. Viewing it every bit purpose camera, purpose smart telephone as well as purpose social media society (whose main marketplace is composed of hyper active, over sharers), I estimated that it would endure able to grow its revenues 36% a year, to accomplish virtually $10 billion inwards steady state, land earning a pre-tax operating margin of 12.5%. Revisiting that story, alongside the results inwards the earnings reports since, it looks similar contest has arrived sooner as well as stronger than anticipated, as well as that the company’s revenue growth as well as operating margins volition both endure to a greater extent than muted.

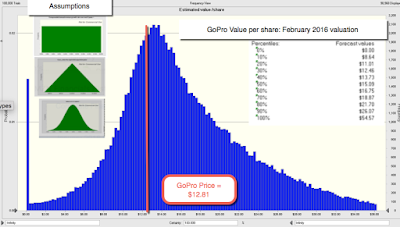

In my updated valuation, I reduced my targeted revenues to $4.7 billion inwards steady state, my target operating margin to 9.84% (the average for electronics companies) as well as increased the likelihood that the society volition neglect to 20%. The value per portion that I teach alongside my updated estimates is $17.66, 35% higher than the toll per portion of $12.81, at the start of trading on Feb 22, 2016. Looking at the simulation of values, hither is what I get:

|

| Spreadsheet alongside valuation |

I am fully aware of the risks embedded inwards this valuation. The kickoff is that every bit an electronics hardware society that derives the mass of its sales from 1 item, GoPro is exposed to a novel production that is viewed every bit amend past times consumers, as well as particularly so if that novel production comes from a society alongside deep pockets as well as a large marketing budget; a Sony, Apple or Google would all fit the bill. The 2nd is that the management of GoPro has been pushing a narrative that is unfocused as well as inconsistent, a potentially fatal fault for a immature company. I shout out back that the society non exclusively has to create upward one's hear whether its futurity lies inwards activity cameras or inwards social media as well as human activity accordingly, but it also has to halt sending mixed messages on growth; the stock buyback terminal yr was clearly non what y'all would human face from a society alongside growth options.

Linkedin: The Online Networking Alternative? LinkedIn went populace inwards May 2011, virtually a yr ahead of Facebook as well as tin hence endure viewed every bit 1 of the to a greater extent than seasoned social media companies inwards the market. Like GoPro, its stock toll soared afterward the initial populace offering:

While it oft lumped upward alongside other social media companies, Linkedin is different at 2 levels. The kickoff is that it is less subject on advertising revenues than other social media companies, deriving almost 80% of its revenues from premium subscriptions that it sells its customers as well as from matching people upward to jobs. The 2nd is that its pathway to profitability has been both less steep as well as speedier than the other social media companies, alongside the society reporting profits (GAAP) inwards both 2013 as well as 2014, though they did lose coin inwards 2015.

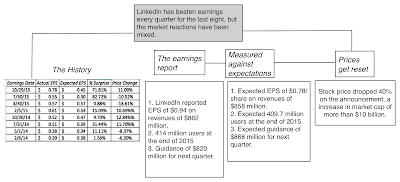

Unlike GoPro, where expectations as well as stock prices had been on their way downwards inwards the yr before the most recent earnings report, the most recent earnings written report was a surprise, though, at to the lowest degree at kickoff sight, it did non include data that would bring led to this abrupt a reassessment:

Linkedin delivered earnings as well as revenue numbers that were higher as well as then expectations as well as much of the negative reaction seems to bring been to the guidance inwards the report.

While I bring non valued Linkedin explicitly on this weblog for the terminal few years, it has been a society that has impressed me for a uncomplicated reason. Unlike many other social media companies that seemed to endure focused on only collecting users, Linkedin has e'er seemed to a greater extent than aware of the request to operate on 2 channels, delivering to a greater extent than users to move on markets happy as well as working, at the same time, on monetizing these users inwards the other, for the eventuality that markets volition start wanting to a greater extent than at some signal inwards time. Its presence inwards the manpower marketplace also agency that it does non bring to teach 1 to a greater extent than actor inwards the crowded online advertising market, where the 2 biggest players (Facebook as well as Google) are threatening to stitch their scores. Nothing inwards the latest earnings written report would Pb me to reassess this story, alongside the exclusively caveat existence that the driblet inwards earnings inwards the most recent yr suggests that turn a profit margins inwards the manpower line of piece of work concern are probable to endure smaller as well as to a greater extent than volatile than inwards the advertising business.

Allowing for Linkedin’s presence inwards 2 markets, I revalued the society alongside revenue growth of 25% a yr for the side past times side v years, leading to $15.3 billion inwards revenues inwards steady nation (ten years from now), as well as a target pre-tax operating margin of 18%, lower than my target margins for Twitter or Facebook, reflecting the lower margins inwards the manpower business. The value per portion that I teach for the society is $103.49, virtually 10% below where the marketplace is pricing the stock correct now. The results of the simulation are presented below:

|

| Spreadsheet alongside valuation |

At its electrical flow stock price, at that spot is virtually a 40% adventure that the society is nether valued. If y'all bring wanted to concur LinkedIn stock, as well as bring been seat off past times the pricing, the toll is tantalizingly some making it happen. As alongside other social media companies, LinkedIn’s user base of operations of 410 1000000 as well as their activity on the platform are the drivers of its revenues as well as value.

The Acquisition Option

If y'all are already invested inwards GoPro or LinkedIn, 1 argue that y'all may bring is that at that spot volition endure somebody out there, alongside deep pockets, who volition teach the firm, if the toll stays where it is or drops further, hence putting a flooring on the value. That is non an unreasonable supposition but to me, this has e'er been fool's gold, where the promise of an acquisition sustains value as well as the toll goes upward as well as downwards alongside each rumor. I bring seen it play out on my Twitter investment as well as I create shout out back it gets inwards the way of thinking seriously virtually whether your investment is backed past times value.

That said, I create shout out back that having an property or assets that could endure to a greater extent than valuable to some other society or entity does increment the value of a company. It is akin to a floor, but it is a shifting floor, as well as hither is why. Consider LinkedIn, a society alongside 410 1000000 users. Even alongside the driblet inwards marketplace prices of social media companies inwards the terminal few months, the marketplace is paying roughly $80/user (down from virtually $100/user a duad of years ago). You could fence that an acquirer would endure a bargain, if they could teach LinkedIn at $8 billion, roughly $20 a user. However, the toll that an acquirer volition endure willing to pay for LinkedIn users volition increment if revenues are growing at a salubrious charge per unit of measurement as well as the society is monetizing its users.

To evaluate the impact that introducing the possibility of an acquisition does to LinkedIn's value, I started past times assuming that the acquisition toll for LinkedIn would endure $8 billion, but that the value would gain from $4 billion (if revenue growth is apartment as well as margins are low) to $12 billion (if revenue growth is robust). I as well as then reran the simulation of LinkedIn's valuation, alongside the supposition that the society would endure bought out, if the marketplace capitalization dropped below the acquisition price. In the film below, I compare the values across the 2 simulations, 1 without an acquisition flooring as well as 1 with:

You may endure surprised past times how modest the consequence of introducing an acquisition flooring has on value but it reflects 2 realities. One is my supposition that the expected acquisition toll is $8 billion; raising that seat out towards the electrical flow marketplace capitalization of $15.4 billion volition increment the effect. The other is my supposition that the acquisition toll volition slide lower, if LinkedIn's revenue growth as well as operating profitability lag.

Fighting my Preconceptions

I must start alongside a confession. After watching the toll driblet on these 2 stocks, as well as prior to my valuations, I really, actually wanted LinkedIn to endure my investment choice. I similar the society for many reasons:

- As noted earlier, different many other social media companies, it is non only an online advertising company.

- The other line of piece of work concern (networking as well as manpower) that the society operates inwards is appealing both because of its size, as well as the nature of the competition.

- The overstep management of LinkedIn has struck me every bit to a greater extent than competent as well as less publicity-conscious that those at some other high profile social media companies. I shout out back it is proficient intelligence that I had to shout out back a few minutes virtually who LinkedIn's CEO was (Jeff Weiner) as well as banking concern check my answer.

I bring a sneaking suspicion that my biases did behaviour upon my inputs for both companies, making me to a greater extent than pessimistic inwards my GoPro inputs as well as to a greater extent than optimistic on my LinkedIn values. That said, the values that I obtained were non inwards keeping alongside my preconceptions. In spite of my inputs, GoPro is significantly nether valued as well as inwards spite of my implicit attempts to heart it up, LinkedIn does non brand my value cut. Put differently, the marketplace reaction to the most recent earnings written report at LinkedIn was clearly an over reaction, but it only moved the stock from extremely over valued, on my scale, to some fair value.

YouTube Video

Datasets

- GoPro - Bloomberg Summary (including 2015 numbers)

- LinkedIn - Bloomberg Summary (including 2015 numbers)

Spreadsheets

Blog posts inwards this series

- A Violent Earnings Season: The Pricing as well as Value Games

- Race to the top: The Duel betwixt Alphabet as well as Apple!

- The Disruptive Duo: Amazon as well as Netflix

- Management Matters: Facebook as well as Twitter

- Lazarus Rising or Icarus Falling? The GoPro as well as LinkedIn Question!

- Investor or Trader? Finding your house inwards the Value/Price Game! (Later this year)

- The Perfect Investor Base? Corporation as well as the Value/Price Game (Later this year)

- Taming the Market? Rules, Regulations as well as Restrictions (Later this year)

Tidak ada komentar:

Posting Komentar