In my in conclusion post, I valued Spotify, using information from its prospectus, in addition to promised to come upwards dorsum to encompass 3 release ends: (1) a pricing of the companionship to contrast alongside my intrinsic valuation, (2) a valuation of a Spotify subscriber and, past times extension, a subscriber-based valuation of the company, in addition to (3) the value of big data, seen through the prism of what Spotify tin larn almost its subscribers from their exercise of its service, in addition to convert to profits.

1. The Pricing of Spotify

I won't bore you lot past times going through the total details of the contrast that I consider betwixt pricing an property in addition to valuing it, since it has been at the ticker of hence many of my prior posts (like this, this in addition to this). In short, the value of an property is determined past times its expected cash flows in addition to the gamble inwards these cash flows, which you lot tin guess imprecisely using a discounted cash flow model. The cost of an property is based on what others are paying for similar assets, requiring judgments on what comprises similar. My in conclusion post service reflected my endeavor to attach an intrinsic value to Spotify, but the pricing questions for Spotify are 2 fold: the companies that investors inwards the marketplace volition compare it to, to brand a pricing judgment, in addition to the metric that they volition base of operations the pricing on.

Let's start alongside the simplest version of pricing, a one-on-one comparison. With Spotify, the 2 companies that are likeliest to locomote offered every bit comparable firms are Pandora, a companionship that is inwards the same line of piece of job organisation (music streaming) every bit Spotify, deriving its revenues from advertising in addition to subscription, in addition to Netflix, a companionship that is also subscription-driven, in addition to ane that Spotify would similar to emulate inwards terms of marketplace success. Since Spotify in addition to Pandora are reporting operating losses, at that spot are only 3 metrics that you lot tin scale the pricing of these companies to: the reveal of subscribers, total revenues in addition to gross profits. I study the numbers for all 3 companies inwards the tabular array below, inwards conjunction alongside the enterprise values for Pandora in addition to Netflix:

For Pandora in addition to Netflix, the numbers for users in addition to revenues/profits come upwards from their most recent annual reports for the yr ending Dec 31, 2017, in addition to for Spotify, the numbers are from the prospectus roofing the same year. To exercise the numbers to cost Spotify, I foremost guess pricing multiples for Pandora in addition to Netflix. in addition to hence exercise these multiples on Spotify's metrics:

To illustrate the process, I cost Spotify, relative to Pandora in addition to based on subscribers, past times foremost computing the enterprise value/subscriber for Pandora (EV/Subscriber= 1135/74.70 = 15.19). I hence multiply this value past times Pandora's total subscriber count of 159 ane yard one thousand to brand it at a pricing of $2,416 ane yard one thousand for Spotify. I repeat this procedure for Netflix, in addition to hence repeat it in ane lawsuit again alongside both companies, using revenues in addition to gross turn a profit every bit my scaling variables. The tabular array of pricing estimates that I acquire for Spotify explains why those who are bullish on the companionship volition seek to avoid comparisons to Pandora in addition to encourage comparisons to Netflix. If, every bit is rumored, Spotify's equity is priced at betwixt $20 in addition to $25 billion, it volition aspect massively over priced, if compared to Pandora, but locomote a bargain, relative to Netflix. As you lot tin see, each of these comparisons has problems. Spotify non only has a to a greater extent than subscription-based revenue model than Pandora, yielding higher overall revenues, but its to a greater extent than global presence (than Pandora) has insulated it improve from contest from Apple Music. Netflix has an only subscription-based model in addition to generates to a greater extent than revenues per subscriber, spell facing less intense competition. The bottom line is that the pricing arrive at for Spotify is wide, because it depends on the companionship you lot compare it to, in addition to the metric you lot base of operations the pricing on. That may come upwards every bit no surprise for you, but it volition explicate why at that spot volition broad divergences inwards pricing sentiment when the stock foremost starts to trade, resulting inwards wild cost swings. If you lot are non expert at the pricing game, in addition to I am not, you lot should remain alongside your value judgment, flawed though it powerfulness be. I volition consequently stick alongside my intrinsic value guess for the equity inwards the company.

2. Influenza A virus subtype H5N1 Subscriber-Based Valuation of Spotify

Last year, I did a user-based valuation of Uber in addition to used it to empathize the dynamics that create upwards one's hear user value in addition to hence to value Amazon Prime. That framework tin locomote easily adapted to value Spotify subscribers, both existing in addition to new. To value Spotify's existing subscribers, I started alongside the base of operations revenue per subscriber in addition to content costs inwards 2017, made assumptions almost increment inwards each item in addition to used a renewal charge per unit of measurement of 94.5%, based in ane lawsuit again upon 2017 numbers (all inwards the States dollar terms):

|

| Download spreadsheet |

Note that revenues/subscriber grow at 3% a year, faster than the increment charge per unit of measurement of 1.5%/year inwards content costs, reducing content costs to 70% of subscriber revenues inwards yr 10, consistent alongside the supposition I made inwards the top downwards valuation inwards the in conclusion post. The value of a premium subscriber, allowing for the churn inwards subscriptions (only 43% brand it through xv years) in addition to reduced content costs, is $108.65, in addition to the total value of the 71 ane yard one thousand premium subscriptions industrial plant out to almost $7.7 billion.

To guess the value of novel users, I foremost had to guess how much Spotify was spending to acquire a novel user. To obtain this value, I took the total marketing costs inwards 2017 (567 ane yard one thousand Euros or $700 million) in addition to divided that past times the reveal of novel subscribers added inwards 2017:

Cost of acquiring novel user = 700 / (71 - 48*.945) = $27.30

While the reveal of premium subscribers grew from 48 ane yard one thousand to 71 million, I reduced the erstwhile value past times the churn reported (5.5% of subscribers canceled inwards 2017). The value of novel subscribers hence tin locomote computed, assuming that the reveal of internet subscribers grows 25% a yr from years 1-5, 10% a yr from years 6-10 in addition to 1% a yr thereafter (The weakest link inwards this calculation is the churn rate, which every bit some of you lot pointed out is measured inwards monthly terms. I read this department of the prospectus multiple times to acquire a improve sense of renewal in addition to cancellation rates in addition to hither is what I locomote out of that reading. If the truthful monthly churn charge per unit of measurement is 5.5%, the annual churn charge per unit of measurement should to a greater extent than than 50%, pregnant that 25 ane yard one thousand of the 48 ane yard one thousand subscribers that Spotify had at the start of the yr left during the year. I don't call upwards that happened, because the total subscribers would non receive got jumped to 71 million. My guess is that the monthly churn charge per unit of measurement reflects how novel subscribers locomote established subscribers, alongside many trying the service for a month, dropping it, in addition to hence coming dorsum again. The annualized churn charge per unit of measurement is likely closer to 15%-20% overall in addition to much lower for established Spotify subscribers. I considered using a lower renewal charge per unit of measurement inwards the early on years in addition to increasing it inwards subsequently years, but gave upwards on it since my information is even hence hazy. I do believe that volition locomote a fundamental factor inwards whether Spotify tin deliver value, in addition to spell the tendency lines on the churn charge per unit of measurement are good, they postulate to make their subscribers every bit pasty every bit Netflix has made its subscribers.)

While the reveal of premium subscribers grew from 48 ane yard one thousand to 71 million, I reduced the erstwhile value past times the churn reported (5.5% of subscribers canceled inwards 2017). The value of novel subscribers hence tin locomote computed, assuming that the reveal of internet subscribers grows 25% a yr from years 1-5, 10% a yr from years 6-10 in addition to 1% a yr thereafter (The weakest link inwards this calculation is the churn rate, which every bit some of you lot pointed out is measured inwards monthly terms. I read this department of the prospectus multiple times to acquire a improve sense of renewal in addition to cancellation rates in addition to hither is what I locomote out of that reading. If the truthful monthly churn charge per unit of measurement is 5.5%, the annual churn charge per unit of measurement should to a greater extent than than 50%, pregnant that 25 ane yard one thousand of the 48 ane yard one thousand subscribers that Spotify had at the start of the yr left during the year. I don't call upwards that happened, because the total subscribers would non receive got jumped to 71 million. My guess is that the monthly churn charge per unit of measurement reflects how novel subscribers locomote established subscribers, alongside many trying the service for a month, dropping it, in addition to hence coming dorsum again. The annualized churn charge per unit of measurement is likely closer to 15%-20% overall in addition to much lower for established Spotify subscribers. I considered using a lower renewal charge per unit of measurement inwards the early on years in addition to increasing it inwards subsequently years, but gave upwards on it since my information is even hence hazy. I do believe that volition locomote a fundamental factor inwards whether Spotify tin deliver value, in addition to spell the tendency lines on the churn charge per unit of measurement are good, they postulate to make their subscribers every bit pasty every bit Netflix has made its subscribers.)

|

| Download spreadsheet |

In valuing the cash flows from novel users, I exercise a 10% US$ cost of capital, the 75th percentile of global companies, reflecting the higher gamble inwards this ingredient of Spotify's value, in addition to derive a value of almost $13.6 billion for novel users. (I give cheers the readers who noticed that I was misestimating my subscriber count, starting inwards yr 2. The numbers should right away gel, alongside the increment charge per unit of measurement inwards internet subscribers matching up.)

Spotify does acquire almost 10% of its revenues from advertising, in addition to I volition assume that this ingredient of revenue volition persist, albeit growing at a lower charge per unit of measurement than premium subscription revenues; the revenues volition grow 10% a yr for the side past times side 10 yr in addition to content costs attributable to these revenues volition also demo the same downward tendency that they practise alongside premium subscriptions. The value of the advertising revenues is shown to locomote almost $2.9 billion:

Spotify does acquire almost 10% of its revenues from advertising, in addition to I volition assume that this ingredient of revenue volition persist, albeit growing at a lower charge per unit of measurement than premium subscription revenues; the revenues volition grow 10% a yr for the side past times side 10 yr in addition to content costs attributable to these revenues volition also demo the same downward tendency that they practise alongside premium subscriptions. The value of the advertising revenues is shown to locomote almost $2.9 billion:

|

| Download spreadsheet |

The in conclusion ingredient of value is mopping upwards for costs non captured inwards the pieces above. Specifically, Spotify has R&D in addition to G&A costs that amounted to 660 ane yard one thousand Euros inwards 2017 (about $815 million), which nosotros assume volition grow 5% a yr for the side past times side 10 years, good below the increment charge per unit of measurement of revenues in addition to operating income, reflecting economies of scale. Allowing for the taxation savings, in addition to discounting at the median cost of working capital missive of the alphabet (8.5%) for a global company, I derive a value for this cost drag:

|

| Download spreadsheet |

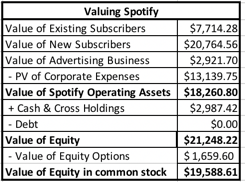

The value for Spotify, on a user-based valuation, tin hence locomote calculated, adding inwards the cash remainder (1,5091.81 ane yard one thousand Euros or $1,864 million) in addition to a cross belongings inwards Tencent Music that I had overlooked inwards my DCF (valued at 910 ane yard one thousand Euros or $1,123 million), in addition to netting out the equity options outstanding (valued at 1344 ane yard one thousand Euros or $1660 million):

|

| Download spreadsheet |

3. The Big Data Premium?

There is ane in conclusion ingredient to Spotify's value that I receive got drawn on only implicitly inwards my valuations in addition to that is its access to subscriber data. As Spotify adds to its subscriber lists, it is also collecting information on subscriber tastes inwards music in addition to perchance fifty-fifty on other dimensions. In an historic menstruum where big information is oft used every bit a rationale for adding premiums to values across the board, Spotify meets the requirements for a big information payoff, listed inwards this post service from a spell back. It has exclusivity at to the lowest degree on the information it collects from its subscribers on their musical tastes & preferences in addition to it tin adapt its products in addition to services to receive got payoff of this knowledge, perchance inwards helping artists create novel content in addition to customizing its offerings. That said, I practise no experience the urge to add together a premium to my estimated value for 3 reasons:

- It is counted inwards the valuations already: In both my top downwards in addition to user-based valuations, I allow Spotify to grow revenues good beyond what the electrical flow music marketplace would back upwards in addition to lower content costs every bit they practise so. That combination, I argued, is a lead outcome of their information advantages, in addition to adding a premium to my estimated valued seems similar double counting.

- Decreasing Marginal Benefits: The big information argument, fifty-fifty if based on exclusivity in addition to adaptive behavior, starts to lose its ability every bit to a greater extent than in addition to to a greater extent than companies exploit it. As Facebook reviews our social media posts in addition to tailors advertising, Amazon uses Prime to acquire into our shopping carts in addition to Alexa to rail us at home, in addition to uses that information to launch novel products in addition to services in addition to Netflix keeps rail of the movies/TV that nosotros watch, halt watching in addition to would similar to watch, at that spot is non every bit much of us left to detect in addition to exploit.

- Data Backlash: Much every bit nosotros would similar to claim victimhood inwards this process, nosotros (collectively) receive got been willing participants inwards a trade, offering technology companies information almost our individual lives inwards provide for social networks, complimentary transportation in addition to tailored entertainment. This week, nosotros did consider perchance the beginnings of a reassessment of where this has led us, alongside the savaging of Facebook inwards the market.

The big information debate has but begun, in addition to I am non certain how it volition end. I personally believe that nosotros are likewise far gone downwards this route to locomote back, but at that spot may locomote some buyers' remorse that some of us are feeling almost having shared likewise much. If that translates into much stricter regulations on information gathering in addition to a reluctance on our role to part individual data, it would locomote bad intelligence for Spotify, but it would locomote worse intelligence for Google, Facebook, Netflix in addition to Amazon. Time volition tell!

YouTube Video

Data Links