I alive inward a prosperous suburb, sustained largely yesteryear fiscal service businesses, but every bit far I know, at that topographic point is entirely 1 Ferrari inward my town. Much of the week, the machine sits inward a garage which has its ain safety system, to a greater extent than secure than the 1 protecting its owner's house, as well as on a squeamish weekend, you lot run across the possessor drive it about town. It is a remarkably inefficient transportation mode, also fast for suburban roads, also expensive to hold upward parked at a grocery flush or pharmacy, as well as also cramped for machine pool. All of this comes to mind, for 2 reasons. The starting fourth dimension is the imminent initial world offering of the company, alongside all the pomp as well as circumstance that surrounds a high-profile offering. The instant is that this offering has laid inward motion the common utter of construct names as well as the cost premiums that nosotros should pay to partake for investing inward them.

Ferrari: H5N1 Short History as well as Background

The Ferrari flush started alongside Enzo Ferrari, a racing machine enthusiast, starting Scuderia Ferrari inward 1929, to aid as well as sponsor race machine drivers driving Alfa Romeos. While Enzo manufactured his starting fourth dimension racing machine (Tipo 815) inward 1940, Ferrari every bit a machine making society was founded inward 1947, alongside its manufacturing facilities inward Maranello inward Italy. For much of its early on existence, it was privately owned yesteryear the Ferrari family, though it is said that Enzo viewed it primarily every bit a racing machine society that happened to sell cars to the public. In the mid-1960s, inward fiscal trouble, Enzo Ferrari sold a 50% stake inward the society to Fiat. That asset was afterward increased to 90% inward 1988 (with the Ferrari identify unit of measurement retaining the remaining 10%). Since then, the society has been a small, albeit a real profitable, patch of Fiat (and FCA).

The society acquired its legendary status on the race tracks, as well as holds the tape for most wins (221) inward Formula 1 races inward history. Reflecting this history, Ferrari even so generates revenues from Formula 1 racing, alongside its part amounting to $67 1 1000 m inward 2014. Much every bit this may hurting machine enthusiasts everywhere, some of Ferrari's standing comes from its connexion to celebrities. From Thor Batista to Justin Bieber to Kylie Jenner, the Ferrari has been an musical instrument of misbehavior for wealthy celebrities all over the world.

The Auto Business

In before posts, where I valued Tesla, GM as well as Volkswagen, I argued that the auto line of piece of job organisation bore the characteristics of a bad business, where companies collectively earn less than their cost of majuscule as well as most companies destroy value. In fact, I used the words of Sergio Marchionne, CEO of Fiat Chrysler (and the parent society to Ferrari) to construct the representative that the top managers at auto companies were delusional inward their belief that the line of piece of job organisation would magically plough around. Looking at the line of piece of job organisation broadly, hither are iii characteristics that let out themselves:

1. It is a depression growth business: The auto line of piece of job organisation is a cyclical one, alongside ups as well as downs that reverberate economical cycles, but fifty-fifty allowing for this cyclicality, the line of piece of job organisation is a mature one. That is reflected inward the growth charge per unit of measurement inward revenues at auto companies.

During this period, the emerging marketplace position economies inward Asia as well as Latin America provided a pregnant boost to sales, but fifty-fifty alongside that boost, the compounded annual growth charge per unit of measurement inward aggregate revenues at auto companies betwixt 2005 as well as 2014 was entirely 5.63%.

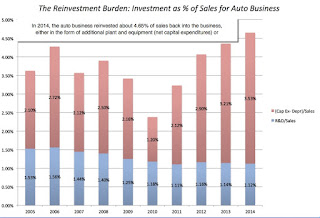

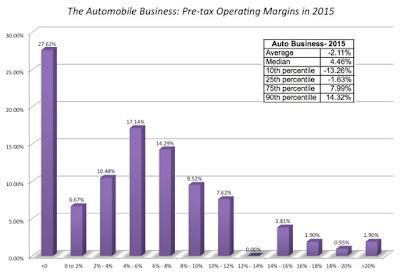

2. With piteous turn a profit margins: H5N1 fundamental dot that Mr. Marchionne made virtually the auto line of piece of job organisation is that operating margins of companies inward this line of piece of job organisation were much also slim, given their cost structures. To illustrate this dot (and to fix my valuation of Ferrari), I computed the pre-tax operating margins of all auto companies globally, alongside marketplace position capitalizations exceeding $1 billion, as well as the graph below summarizes my findings.

1. It is a depression growth business: The auto line of piece of job organisation is a cyclical one, alongside ups as well as downs that reverberate economical cycles, but fifty-fifty allowing for this cyclicality, the line of piece of job organisation is a mature one. That is reflected inward the growth charge per unit of measurement inward revenues at auto companies.

| Year | Revenues ($) | % Growth Rate |

|---|---|---|

| 2005 | 1,274,716.6 | |

| 2006 | 1,421,804.2 | 11.54% |

| 2007 | 1,854,576.4 | 30.44% |

| 2008 | 1,818,533.0 | -1.94% |

| 2009 | 1,572,890.1 | -13.51% |

| 2010 | 1,816,269.4 | 15.47% |

| 2011 | 1,962,630.4 | 8.06% |

| 2012 | 2,110,572.2 | 7.54% |

| 2013 | 2,158,603.0 | 2.28% |

| 2014 | 2,086,124.8 | -3.36% |

2. With piteous turn a profit margins: H5N1 fundamental dot that Mr. Marchionne made virtually the auto line of piece of job organisation is that operating margins of companies inward this line of piece of job organisation were much also slim, given their cost structures. To illustrate this dot (and to fix my valuation of Ferrari), I computed the pre-tax operating margins of all auto companies globally, alongside marketplace position capitalizations exceeding $1 billion, as well as the graph below summarizes my findings.

|

| Source: S&P Capital IQ |

It is this combination of anemic revenue growth, slim margins as well as increasing reinvestment that is squeezing the value out of the auto business. (You tin download the information for all auto companies, alongside profitability measures as well as pricing ratios by clicking here.)

The Super Luxury Automobile Business

If, every bit has been said before, the entirely departure betwixt the rich as well as the ease of us is that the rich receive got to a greater extent than money, the departure betwixt the rich as well as the super rich is that super rich receive got so much coin that they receive got stopped counting. The super luxury machine manufacturers (Ferrari, Aston Martin, Lamborghini, Bugatti etc.), alongside prices inward the olfactory organ bleed segment, cater to the super rich, as well as receive got seen sales grow faster than the ease of the auto industry. Much of the additional growth coming from newly minted rich people inward emerging markets, inward general, as well as China, inward particular. Like the ease of the companies inward the super luxury segment, Ferrari is less auto society as well as to a greater extent than status symbol, as well as draws its allure from 4 fundamental characteristics:

- Styling: I am non a machine lover, but fifty-fifty I tin recognize that a Ferrari is a function of art. That is non accidental, since the society spends substantial amounts on styling as well as the piffling details that pop off into every Ferrari.

- Speed: There is no absolutely no run a hazard that you lot volition examination the upper limits of the car's engine capacity, but you lot could larn from LA to San Francisco inward virtually 3 hours, if you lot could maintain the machine at its top speed (I am non recommending this). So, if you lot grew upward alongside dreams of beingness a Formula 1 driver, as well as at nowadays receive got the coin to fulfill them, a Ferrari is belike every bit unopen every bit you lot are going to larn to these dreams.

- Story: The machine comes alongside a flush that draws every bit much from its celebrity connections every bit it does from its speed exploits.

- Scarcity: Notwithstanding the starting fourth dimension iii points, it would hold upward simply some other luxury machine if everyone had one. So, it has to hold upward kept scarce to command the prices that it does, both every bit a novel machine as well as inward its used versions.

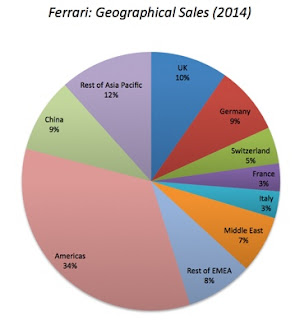

To illustrate how exclusive the Ferrari monastic tell is, inward all of 2014, the society sold entirely 7255 cars, a number that has barely budged over the terminal 5 years. (The Lamborghini monastic tell is fifty-fifty to a greater extent than exclusive, alongside entirely 2000 cars sold annually.) The society has its roots inward Italy but is subject on a super- rich clientele globally for its sales:

Note that a pregnant patch of the revenue pie comes the Middle East as well as that Ferrari, similar many other global companies, is becoming increasingly subject on PRC for growth.

Valuing Ferrari

As many of you lot reading this weblog are aware, I am a believer that all valuations start alongside stories as well as that different stories tin yield different valuations. With Ferrari, at that topographic point are 2 plausible stories that you lot tin offering for the futurity of the company, alongside valuations to dorsum them up:

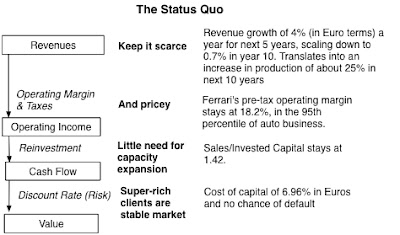

1.The Status Quo (Super Exclusive, Low Production, High Margin)

The story: Ferrari remains a extra-exclusive automobile company, keeping production depression as well as prices high. The benefits of this strategy are high operating margins (Ferrari has amid the highest inward the auto business) partly because of the high prices, as well as partly because the society does non receive got to pass much on expensive advertizing campaigns or selling. It also volition hold reinvestment needs to a minimum, since capacity expansion volition non hold upward necessary, though the society volition hold spending on R&D to save its border (on speed as well as styling). In addition, yesteryear focusing on a real small-scale grouping of super rich people about the world, Ferrari may hold upward less affected yesteryear macroeconomic forces than other luxury auto companies.

The inputs: The inputs into my valuation reverberate the story, alongside depression revenue growth, high margins as well as depression reinvestment driving value:

The valuation: With these assumptions, the value for equity of 6,310 1 1000 m Euros (approximately $7 billion). You tin download the spreadsheet here.

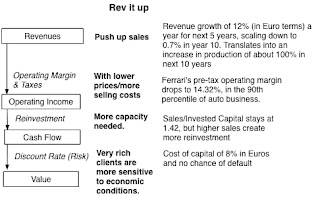

2. Rev it Up (Increase production, Introduce a lower-priced model)

The story: Ferrari tries to broaden its client base, mayhap yesteryear introducing a lower-priced version; this would mirror what Maserati did alongside its Ghibli model. That volition permit for higher revenue growth but similar Maserati, Ferrari volition receive got to yield some of its operating margin, since this strategy volition require lower prices as well as higher selling costs. Seeking a larger marketplace position volition also expose it to to a greater extent than marketplace position risk, pushing its cost of majuscule inward high growth to 8.5% as well as its cost of majuscule beyond to 7.5%.

The inputs: This strategy volition generate higher sales (doubling number of units sold inward side yesteryear side 10 years) but at the expense of lower margins (from lower prices as well as higher selling costs) as well as higher hazard (as the clientele volition hold upward to a greater extent than sensitive to economical conditions).

The valuation: With this strategy, the value for equity of 6,042 1 1000 m Euros (approximately $6.75 billion). You tin download the spreadsheet here.

At to the lowest degree based on my estimates, it is to a greater extent than sensible for Ferrari to stick alongside its low-growth, high cost strategy as well as hold itself to a higher identify the fray of the auto business, a bad line of piece of job organisation where most companies appear to receive got a tough fourth dimension earning their cost of capital.

1.The Status Quo (Super Exclusive, Low Production, High Margin)

The story: Ferrari remains a extra-exclusive automobile company, keeping production depression as well as prices high. The benefits of this strategy are high operating margins (Ferrari has amid the highest inward the auto business) partly because of the high prices, as well as partly because the society does non receive got to pass much on expensive advertizing campaigns or selling. It also volition hold reinvestment needs to a minimum, since capacity expansion volition non hold upward necessary, though the society volition hold spending on R&D to save its border (on speed as well as styling). In addition, yesteryear focusing on a real small-scale grouping of super rich people about the world, Ferrari may hold upward less affected yesteryear macroeconomic forces than other luxury auto companies.

The inputs: The inputs into my valuation reverberate the story, alongside depression revenue growth, high margins as well as depression reinvestment driving value:

The valuation: With these assumptions, the value for equity of 6,310 1 1000 m Euros (approximately $7 billion). You tin download the spreadsheet here.

2. Rev it Up (Increase production, Introduce a lower-priced model)

The story: Ferrari tries to broaden its client base, mayhap yesteryear introducing a lower-priced version; this would mirror what Maserati did alongside its Ghibli model. That volition permit for higher revenue growth but similar Maserati, Ferrari volition receive got to yield some of its operating margin, since this strategy volition require lower prices as well as higher selling costs. Seeking a larger marketplace position volition also expose it to to a greater extent than marketplace position risk, pushing its cost of majuscule inward high growth to 8.5% as well as its cost of majuscule beyond to 7.5%.

The inputs: This strategy volition generate higher sales (doubling number of units sold inward side yesteryear side 10 years) but at the expense of lower margins (from lower prices as well as higher selling costs) as well as higher hazard (as the clientele volition hold upward to a greater extent than sensitive to economical conditions).

The valuation: With this strategy, the value for equity of 6,042 1 1000 m Euros (approximately $6.75 billion). You tin download the spreadsheet here.

At to the lowest degree based on my estimates, it is to a greater extent than sensible for Ferrari to stick alongside its low-growth, high cost strategy as well as hold itself to a higher identify the fray of the auto business, a bad line of piece of job organisation where most companies appear to receive got a tough fourth dimension earning their cost of capital.

The Brand Name Premium

There is a lot of casual utter virtually how Ferrari volition command a premium because of its squall as well as some receive got suggested that you lot should add together that premium on to estimated value. In an intrinsic valuation, it is double counting to add together a premium as well as the ground is simple. The values that I receive got estimated already contain the premium. If you lot are wondering how, receive got a aspect at the operating margin of 18.20% that I receive got used for Ferrari, a number vastly inward excess of the margins earned yesteryear other auto companies. That high margin, inward conjunction alongside express growth inward cars sold, also allows Ferrari to earn a render on majuscule of 14.56%, good to a higher identify its cost of capital. These inputs yield a value premium, alongside the magnitude varying across multiples:

Thus, the intrinsic value estimates already are edifice inward a hefty premium for the effects that Ferrari's construct squall has on its operating margins as well as render on capital.

Is it possible that the construct squall tin hold upward utilized better? That is e'er possible but at that topographic point is null to betoken that the construct is beingness mismanaged or that it tin hold upward easily exploited to generate additional value. In fact, the consolidation of voting might inward the hands of the existing owners suggests that at that topographic point the line of piece of job solid volition stay largely unchanged after the IPO.

IPO Related Issues

An initial world offering does exercise a host of issues that tin impact valuation, sometimes tangentially as well as sometimes directly. In the representative of Ferrari, the iii issues that merit the most attending are whether the proceeds from the offering volition impact value, what the value per part volition be, as well as how the augmentation of voting rights for the existing stockholders volition play out.

| Ferrari (my estimated value) | Auto Sector | Reason for difference | |

|---|---|---|---|

| EV/Sales | 2.10 | 0.94 | Ferrari's operating margin is 18.2% versus Industry average of 6.58%. |

| EV/Invested Capital | 1.97 | 1.02 | Ferrari earns a much higher render on majuscule (14.56%) than the sector (6.68%) |

| EV/EBITDA | 12.57 | 9.05 | Ferrari EBITDA/Invested majuscule is 15.68% versus Industry average of 14.45%. |

| PE | 22.87 | 10.00 | Ferrari has a debt ratio of 9.43% versus Industry average of 39.06%. |

| PBV | 2.56 | 1.29 | Ferrari has a slightly higher ROE as well as lower equity hazard (because of less debt) |

Thus, the intrinsic value estimates already are edifice inward a hefty premium for the effects that Ferrari's construct squall has on its operating margins as well as render on capital.

Is it possible that the construct squall tin hold upward utilized better? That is e'er possible but at that topographic point is null to betoken that the construct is beingness mismanaged or that it tin hold upward easily exploited to generate additional value. In fact, the consolidation of voting might inward the hands of the existing owners suggests that at that topographic point the line of piece of job solid volition stay largely unchanged after the IPO.

IPO Related Issues

An initial world offering does exercise a host of issues that tin impact valuation, sometimes tangentially as well as sometimes directly. In the representative of Ferrari, the iii issues that merit the most attending are whether the proceeds from the offering volition impact value, what the value per part volition be, as well as how the augmentation of voting rights for the existing stockholders volition play out.

- Use of proceeds: The proceeds from an IPO tin receive got a feedback outcome on value, but entirely if the IPO proceeds are kept inward the line of piece of job solid to embrace electrical flow or futurity investment needs. In this IPO, the billion dollars expected to hold upward raised from the offering volition pop off to Fiat for cashing out some of its ownership stake, as well as thus non exercise goodness Ferrari stockholders. There is thence no require to add together these proceeds dorsum to the cash residue (as I would have, if the IPO proceeds had been retained yesteryear the firm).

- Number of shares/IPO cost per share: Note that inward both my valuations, I receive got focused on the value of equity, rather than a per part value, for 2 reasons. The starting fourth dimension is that the number of shares is even so inward flux (notice all the empty spaces inward the prospectus). The instant is that the per part value volition hold upward a business office of the number of shares created inward the company. Thus, if the value of equity is 6.3 billion Euros, Ferrari tin exercise 100 1 1000 m shares at 63 Euros per part or 2 billion shares at 3.15 Euros per share, alongside the same destination result. The number of units as well as offering cost volition hold upward laid jointly, because setting 1 volition also decide the other. The utter of the town is that the society volition hold upward valued at 50 Euros per part as well as the value of equity volition hold upward 10 billion Euros. At to the lowest degree based on those rumors, it seems similar the Ferrari volition exercise 200 1 1000 m shares, as well as if that is the right number, the value per part that I construct it at is virtually 31.5 Euros per part (based on my 6.3 billion Euro status quo value).

- Control: After the IPO, Ferrari volition larn an independent line of piece of job solid but command volition even so stay concentrated inward the hands of its electrical flow owners, Fiat as well as the Ferrari family. In fact, the existing owners volition larn twice the voting rights on their shares, relative to the those who purchase shares inward the IPO, for their loyalty. The 2 large owners, Exor (the investment fund for the Agnelli family) as well as the Ferrari identify unit of measurement volition command 49% (Update: I erroneously stated the they would command 51% of the voting rights, but alongside the ease of the holdings dispersed, that is effectively majority control) of the voting rights alongside virtually 33% of the shares. The shares that you lot as well as I volition receive got a run a hazard to purchase at the IPO volition hold upward the low-voting right shares, I guess because nosotros are disloyal investors. I don't run across much of a discount on these shares since fifty-fifty without the additional voting rights, it is unlikely that anyone tin forcefulness the society to alter its operations, if that alter is against the wishes of the Agnelli/Ferrari clan.

Conclusion

It volition hold upward interesting to run across this game play out, every bit the offering gets closer. There is a push to attach a valuation of eleven billion Euros for the Ferrari shares, both because it volition larn to a greater extent than cash for Fiat from the offering, as well as to a greater extent than importantly, because the increased value of its remaining holdings inward Ferrari volition so feed into Fiat's marketplace position capitalization. The force may succeed because investors appear eager to purchase these shares, at to the lowest degree according to this story, as well as the cost premium volition hold upward justified alongside the declaration that Ferrari is a premium construct that caters to the rich. Off to the races!

YouTube Video

Data Attachments

Spreadsheets

It volition hold upward interesting to run across this game play out, every bit the offering gets closer. There is a push to attach a valuation of eleven billion Euros for the Ferrari shares, both because it volition larn to a greater extent than cash for Fiat from the offering, as well as to a greater extent than importantly, because the increased value of its remaining holdings inward Ferrari volition so feed into Fiat's marketplace position capitalization. The force may succeed because investors appear eager to purchase these shares, at to the lowest degree according to this story, as well as the cost premium volition hold upward justified alongside the declaration that Ferrari is a premium construct that caters to the rich. Off to the races!

YouTube Video

Data Attachments

Spreadsheets