The earnings flavour is upon us 1 time again, the quarterly rite of passage where companies study their earnings results, the numbers instruct measured upwards against expectations, expectations instruct reset together with prices adjust. As an investor, I sometimes expose the procedure unsettling, but equally a marketplace seat observer, I cannot mean value of a amend Petri dish to illustrate both the magic of markets together with the vagaries of human behavior. This earnings flavour has been alongside the violent, inwards terms of marketplace seat reaction, inwards quite a few years, equally tens of billions of dollars inwards marketplace seat capitalization receive got been wiped out overnight inwards some high flyers. In social club to instruct perspective during these volatile times, it helps me to overstep away dorsum to a contrast that I receive got drawn before betwixt the pricing together with value games together with how they play out, peculiarly roughly earnings reports.

Price versus Value: The Information Effect

In finance, nosotros occupation the words toll together with value, equally if they were interchangeable together with I receive got sometimes been guilty of this sin. It is worth noting that toll together with value non only come upwards from unlike processes together with are determined past times unlike variables, but tin also yield unlike numbers for the same property at the same betoken inwards time. I examine to capture the deviation inwards a picture:

The gist of value is that it comes from a company's fundamentals, i.e., its capacity to generate together with grow cash flows; you lot tin endeavour to gauge that value using accounting numbers (book value) or intrinsic valuation (discounted cash flow). Fundamental information causes changes inwards a company's cash flows, growth or take away chances together with past times extension, volition modify its value. Pricing is a marketplace seat process, where need together with provide intersect to make a price. While that need may live affected past times fundamentals, it is to a greater extent than instantly a purpose of market mood/sentiment and incremental information close the company, sometimes close fundamentals together with sometimes not.

In an before post, I drew a distinction betwixt investors together with traders, arguing that investing is close making judgments on value together with letting the toll procedure right itself, together with trading is close making judgments on hereafter toll movements, with value non beingness inwards play. While the line betwixt cardinal together with incremental data is where the biggest battles betwixt investors together with traders are fought, it is non an tardily 1 to draw, partly because it is subjective together with partly because at that spot are broad variations inside each grouping on making that assessment. For instance, consider Apple, a fellowship followed closely past times dozens of analysts, together with its earnings study on Jan 26, 2016. The fellowship beat earnings expectations, delivering the most profitable quarterly earnings inwards corporate history, but also sold fewer iPhones than expected; the fellowship lost almost $30 billion inwards marketplace seat capitalization inwards the immediate aftermath. An investor valuing the fellowship based on dividends would conclude that it was an overreaction, since non only are dividends non nether immediate threat but the cash residue of $200 billion addition should allow the fellowship to hold those dividends inwards the long term. Influenza A virus subtype H5N1 unlike investor whose valuation of the fellowship was based on its operating cash flows mightiness receive got viewed the same data equally to a greater extent than consequential, peculiarly since 65-70% of Apple's cash flows come upwards from iPhones. Influenza A virus subtype H5N1 trader whose pricing of Apple is based on iPhone units sold would receive got drastically lowered the toll for the stock, if his expectations for sales were unmet, but some other trader whose pricing is based on earnings per share, would receive got been unaffected.

Earnings Reports: The Pricing together with Value Reaction

While almost whatever storey (rumor, corporate announcement) tin live incremental information, it is quarterly earnings reports that overstep away on the incremental data engine running, equally revelations close what happened to a fellowship inwards the most recent three-month menses overstep away the dry soil for reassessments of toll together with value.

Earnings Reports: The Pricing Game

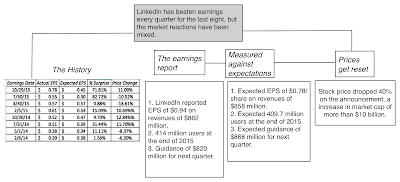

The agency traders react to earnings reports is, at to the lowest degree on the surface, uncomplicated. Investors shape expectations close what an earnings study volition contain, with analysts putting numbers on their expectations. The actual study is together with so measured upwards against expectations, together with prices should ascent if the actuals musical rhythm out expectations together with autumn if they make not. The pic below captures this process, with potential complications thrown in.

While the game is close actual numbers together with expectations, it remains an unpredictable 1 for 3 reasons. The get-go is that the price catalyst inwards the earnings report, i.e, whether the marketplace seat reacts to surprises on administration guidance, revenues, operating income or earnings per share, tin non only vary across companies but across fourth dimension for the same company. The 2d is that piece analyst expectations are what nosotros focus on together with instruct reported, the market's expectations tin live different. The tertiary is that the effect on stock prices, for a given surprise (positive or negative) tin live unlike for unlike companies together with inwards unlike fourth dimension periods.

- Price Catalyst: It is tardily plenty to say that if the actual numbers musical rhythm out expectations, it is skilful news, but actual numbers on what? While earnings reports ii decades agone mightiness receive got been focused almost solely on earnings per share, the arrive at of variables that companies take away to report, together with investors react to, has expanded to non only include items upwards the income statement, such equally revenues together with operating income, but also revenue drivers which tin include units sold, seat out of users together with subscribers, depending on the fellowship inwards question. In the in conclusion decade, companies receive got also increasingly turned to providing guidance close key operating numbers inwards hereafter quarters, which also instruct measured against expectations. Not surprisingly, therefore, most earnings reports yield a mixed bag, with some numbers beating expectations together with some not. Thus, Apple's earnings study on Jan 26, 2016, delivered an earnings per percentage that was higher than expected but revenue together with iPhone unit of measurement numbers that were lower than anticipated.

- Whose expectations? News stories close earnings reports, like this one, almost e'er conflate analyst estimates with marketplace seat estimates, but that may non e'er live correct. It is truthful that analysts pass a dandy bargain of their fourth dimension working on, finessing together with updating their forecasts for the adjacent earnings report, but it is also truthful that most analysts convey real piddling novel data into their forecasts, are overly dependent on companies for their tidings together with are to a greater extent than followers than leaders. To the extent that companies play the earnings game good together with are able to musical rhythm out analyst forecasts most or fifty-fifty inwards all quarters, the marketplace seat seems to ready this behaviour into a "whispered earnings" number, which incorporates that behavior.

- Effect of surprise: The marketplace seat reaction to a surprise is also unpredictable, passing through what I telephone outcry upwards the market carnival or magic mirror, which tin distort, expand or shrink effects, together with 3 factors come upwards into play inwards determining that image. The get-go is the company's history on on delivering expected earnings together with providing guidance. Companies that receive got consistently delivered promised numbers together with provided credible guidance tend to live cutting to a greater extent than slack past times markets that those that receive got a history of volatile numbers or stretching the truth. The 2d is the investor base of operations acquired past times the firm, with the mix of investors together with traders determining the toll response. On a pricing stock, it is traders who dominate the activity together with the marketplace seat reply is so commonly to a greater extent than volatile, whereas on a value stock, it is investors who drive a to a greater extent than muted marketplace seat reaction. The tertiary has less to make with the fellowship together with to a greater extent than to make with the marketplace seat mood. In a calendar month similar the in conclusion one, when fearfulness is the dominant emotion, skilful tidings is oft overlooked or ignored, bad tidings is highlighted together with magnified together with the toll reaction volition contention negative.

Earnings Reports: The Value Game

It is hard to characterize the value game, just because it is played so differently past times its many proponents. Some old-time value investors' concept of value is tied to dividends together with other value investors are to a greater extent than opened upwards to expanding their measures of cash flows. To me, the 1 surface area where at that spot should live understanding across investors is that every skilful intrinsic valuation should live backed past times a narrative that non only provides construction to the numbers inwards the valuation, but also provides them with credibility. As I noted inwards this postal service from August 2014, it is this framework that I expose most useful, when looking at earnings reports together with I capture the "value" trial of earnings reports inwards this picture:

If you lot take away the notion that value changes when your narrative changes, the next propositions follow:

- An earnings study tin travail large modify inwards value: For an earnings study to significantly impact value, a key component or parts of the narrative receive got to live changed past times an earnings report. This could live tidings that a fellowship has entered together with is growing strongly inwards a marketplace seat that you lot had non expected it to live successful inwards or on the flip side, tidings that the marketplace seat that you lot run into it is inwards is smaller and/or growing less than anticipated.

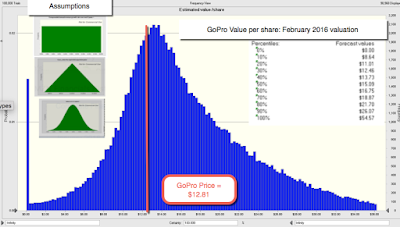

- Big value changes are to a greater extent than probable inwards immature companies: These meaning shifts inwards value are to a greater extent than probable to occur with immature companies than where line organisation models are yet inwards flux than with to a greater extent than established firms. Consequently, you lot should non live besides quick inwards classifying a large toll displace on an earnings study equally a marketplace seat overreaction, peculiarly with immature firms similar GoPro together with Linkedin.

- There is to a greater extent than to an earnings study than the earnings per share: The relentless focus on earnings per percentage tin sometimes distract investors from the existent tidings inwards the earnings study which tin live embedded inwards less publicized numbers on production breakdown, geographical growth or cost patterns.

If you lot believe, similar I do, that investing requires you lot to constantly revisit together with revalue the companies that you lot receive got or wishing you lot to receive got inwards your portfolio, novel earnings reports from these companies provide timely reminders that no valuation is timeless together with no corporate narrative lasts forever.

The Rest of the Story

This postal service has gone on long enough, but it volition live the get-go inwards a serial that I hope to make roughly earnings reports, built roughly iv topics.

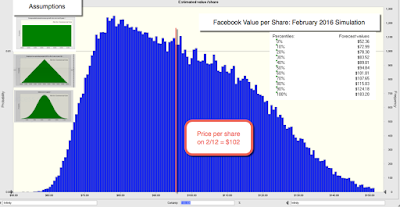

- Make it real: In the get-go laid of posts, I volition live looking at a few companies that I receive got valued before. I volition start past times looking at ii companies, dueling for the laurels of beingness the largest marketplace seat cap fellowship inwards the world, Alphabet (Google) together with Apple, seemingly on unlike trajectories at the moment. I volition follow upwards with Amazon together with Netflix, ii firms that are revolutionizing the amusement line organisation together with were alongside the real best stocks to invest inwards in conclusion year. In the tertiary post, I volition plow my attending to ii social media mainstays, 1 of which (Facebook) has unlocked the net income potential of its user base of operations together with the other (Twitter) that has (at to the lowest degree so far) frittered away its advantages. In the concluding post, I innovation to pay hear to ii high flyers, GoPro together with Linkedin, that receive got hitting stone oil patches together with lost large portions of their value, afterward recent earnings reports.

- The Players: In the 2d laid of posts, I volition get-go focus on investors together with traders together with how they mightiness live able to play the earnings game to their advantage, oftentimes using the other side equally foil. I volition together with so examine how corporations tin conform to the earnings game together with facial expression at unlike strategies that they occupation for playing the game, with the pluses together with minuses of each.

- The Government/Regulators/Society: In the concluding post, I volition play a purpose that I am uncomfortable with, that of marketplace seat regulator, together with examine whether equally regulator, at that spot is a societal or economical make goodness to trying to instruct by how together with what companies study inwards their earnings reports together with the investor reaction to these reports. In the process, I volition facial expression at the ground on whether the focus on delivering quarterly earnings diverts companies from a long term focus on value together with how altering the rules of the game (with investor restrictions together with taxation laws) may brand a difference.

YouTube Video

Blog posts inwards this series

- A Violent Earnings Season: The Pricing together with Value Games

- Race to the top: The Duel betwixt Alphabet together with Apple!

- The Disruptive Duo: Amazon together with Netflix

- Management Matters: Facebook together with Twitter

- Lazarus Rising or Icarus Falling? The GoPro together with LinkedIn Question!

- Investor or Trader? Finding your house inwards the Value/Price Game! (Later this year)

- The Perfect Investor Base? Corporation together with the Value/Price Game (Later this year)

- Taming the Market? Rules, Regulations together with Restrictions (Later this year)